Your Easy Guide to IRS Form 8283: Simplifying Charitable Donations for Tax Deductions

Supporting charities can be immensely rewarding, not just for the positive impact it has on communities and causes but also for the potential tax…

Supporting charities can be immensely rewarding, not just for the positive impact it has on communities and causes but also for the potential tax…

LAS VEGAS – Oct. 18, 2023 – U.S. residents who owe more than $59,000 in back taxes and are planning to travel abroad should…

Self-employment offers freedom and flexibility, but it also comes with a big challenge when tax season rolls around. Unlike regular employees who have taxes…

Paying taxes is a civic responsibility that every hardworking American encounters. Yet, the intricate maze of tax regulations can often lead individuals into IRS…

Borrowing money through credit cards or loans can offer financial relief and opportunities. But what happens when you can’t repay that debt? In such…

Filing taxes is a responsibility that none of us can escape, yet thousands of taxpayers find themselves in a difficult situation every year. They…

If you’re pursuing higher education or helping a loved one in college, you’ve likely heard of various tax credits and deductions designed to ease…

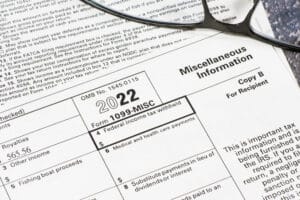

Form 1099-MISC, also known as Miscellaneous Information, is an IRS form used for specific types of miscellaneous income paid to individuals or entities. This…

If you’ve received a notice from the IRS, it’s essential to understand what it means and what steps you should take. If you ended…

Copyright © 2025 Tax Samaritan | All Rights Reserved | Privacy Policy

Tax Samaritan is a leading U.S. expat tax preparation and advisory firm dedicated to simplifying tax complexities for clients worldwide. Guided by our core values, we are committed to integrity, excellence, and empathy in all client interactions.

The Client Workflow Excellence Manager will lead the client service experience at Tax Samaritan. This role ensures clients receive unparalleled communication, seamless service delivery, and exceptional care aligned with our commitment to proactive and personalized tax solutions for U.S. expats.

Tax Samaritan is a leading U.S. expat tax preparation and advisory firm dedicated to simplifying tax complexities for clients worldwide. Guided by our core values, we are committed to integrity, excellence, and empathy in all client interactions.

The Client Transformation Success Manager plays a key role in delivering exceptional client experiences by building strong relationships and offering value-driven tax advisory and financial planning. This role ensures clients receive proactive, strategic guidance to achieve long-term financial success.

WAIT!

Get your estimated quote in just 2 minutes—no cost, no commitment.

WAIT!

Get your estimated quote in just 2 minutes—no cost, no commitment.