Traditional financial planning reacts to problems. Proactive planning anticipates them. At Tax Samaritan, we don’t just prepare for tax season—we help you prepare for life.

Whether you’re growing a business, protecting your family’s wealth, or preparing for a major transition, our Proactive Planning service provides a clear, forward-looking strategy to minimize surprises and maximize opportunities.

What is Proactive Planning?

Proactive Planning is a forward-thinking, holistic approach to managing your personal and business finances. It goes beyond tax preparation and investment advice. It means examining every aspect of your financial life—your goals, risks, opportunities, and even the things you haven’t considered yet and building a strategy that adapts as your life evolves.

Instead of waiting for problems or deadlines, we identify issues and opportunities early and help you act on them with confidence.

the Advantages

When you plan ahead, you make better decisions. It’s that simple.

Proactive planning gives you the space to think strategically, rather than scrambling at the last minute. You’re not just reacting to tax changes or market shifts, you’re managing them before they become a problem.

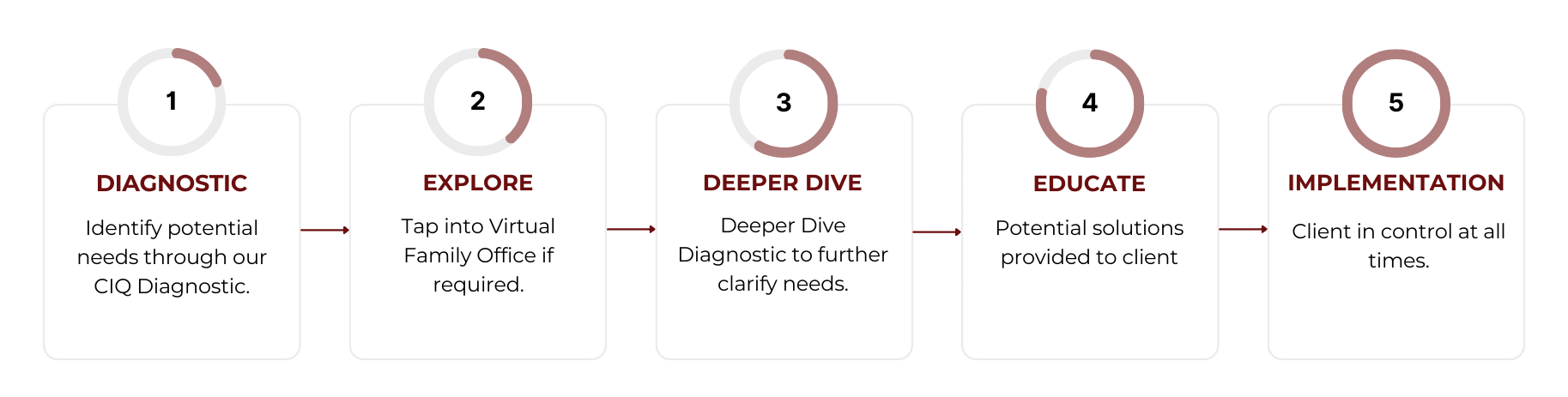

Our MAP Proactive Planning Process

Our MAP process (Maximize, Advise, Protect) isn’t one-size-fits-all. It’s designed around your goals and tailored through five key phases:

The Virtual Family Office (VFO)

When you engage with Proactive Tax Planning, you’re not just working with our planning team. You also gain access to our Virtual Family Office (VFO), a nationwide network of top-tier specialists across wealth management, legal, tax, risk, and business advisory.

The VFO is built on the same concept that the Rockefeller family pioneered in 1882: a coordinated team working across every area of your financial life. The difference? We’ve made it virtual, accessible, and cost-effective.

Our specialists don’t work in silos. They collaborate directly with our planning team to deliver custom-fit strategies, so you don’t have to juggle multiple advisors or chase down answers.

Core Areas of the Virtual Family Office

Wealth Management

A complete financial strategy that protects your wealth, supports your goals, and builds a balanced portfolio.

Risk Management

Protects your wealth and well-being with strategies that safeguard against life’s uncertainties.

Legal Services

Provides the legal foundation to protect your wealth, your business, and your family’s future.

Tax Planning

Reduces tax liabilities and maximizes long-term wealth through proactive financial strategies.

Business Advisory

Guides business owners with strategies to strengthen operations, improve performance, and achieve growth.

Why Choose Proactive Tax Planning?

Most tax firms look backward. We look forward. With our Proactive Tax Planning service, you’re not just filing returns; you’re building a strategy that anticipates what’s next.

Our Virtual Family Office gives you access to tax, legal, wealth, risk, and business specialists who work together to protect and grow what you’ve built. Instead of piecing together advice from different professionals, you get a coordinated plan that aligns every decision with your bigger goals.

The result? Less stress, more control, and a clear path to building, preserving, and transferring wealth on your terms.

Ready to stop reacting and start planning ahead? Click the link below to schedule your free 30-minute consultation today.

What Our Clients Are Saying

Tax Samaritan did a great job for my most recent tax year, efficient and on time. I have used two other companies online before but Randall’s personal touch and advise outshines all others. You won’t be disappointed if you engage with Tax Samaritan!

— David W

JALPAIGURI, INDIA

Tax Samaritan is excellent to work with. They worked through some complicated issues and have been professional all the way. I highly recommend them to anyone, especially expats. They understand how complicated it can be.

— Paul K

COLORADO, USA

Talk To An Expert

Ready to start saving money on your taxes? Please click the button below to talk to one of our expat tax experts. We are also available to discuss any other tax or planning concerns you may have.