The Most Comprehensive Guide to Social Security Tax for Expats

Social Security provides a safety net to workers when they retire. But rules on Social Security tax can be confusing for expats. Let this guide help you out.

Social Security provides a safety net to workers when they retire. But rules on Social Security tax can be confusing for expats. Let this guide help you out.

As one of the backbones of our nation’s supply chain, truck drivers play a vital role in keeping our economy moving. They transport everything…

Being a truck driver comes with its own set of challenges. The job may offer good pay, but the demanding nature of the work…

What is a W-9 Form? The IRS Form W-9, or “Request for Taxpayer Identification Number and Certification,” is used by U.S. taxpayers to provide…

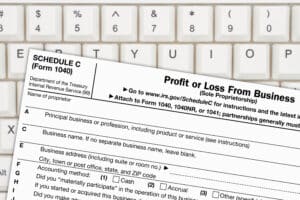

Running a business involves managing a packed schedule. Tax season adds to the workload with extra paperwork. If you’re among the ten percent of…

If you’re a freelancer or small business owner, the danger of neglecting estimated quarterly tax payments looms large over your financial stability. When you’re…

Self-employment offers freedom and flexibility, but it also comes with a big challenge when tax season rolls around. Unlike regular employees who have taxes…

Being an independent contractor comes with numerous benefits, such as flexible schedules and greater control over your work. However, it also entails additional responsibilities,…

How does FEIE work? And how can you take advantage of it? If you’re a self-employed expat who wishes to maximize your tax deductions, this infographic will provide a comprehensive overview of FEIE and how to take advantage of it.

Copyright © 2025 Tax Samaritan | All Rights Reserved | Privacy Policy

Tax Samaritan is a leading U.S. expat tax preparation and advisory firm dedicated to simplifying tax complexities for clients worldwide. Guided by our core values, we are committed to integrity, excellence, and empathy in all client interactions.

The Client Workflow Excellence Manager will lead the client service experience at Tax Samaritan. This role ensures clients receive unparalleled communication, seamless service delivery, and exceptional care aligned with our commitment to proactive and personalized tax solutions for U.S. expats.

Tax Samaritan is a leading U.S. expat tax preparation and advisory firm dedicated to simplifying tax complexities for clients worldwide. Guided by our core values, we are committed to integrity, excellence, and empathy in all client interactions.

The Client Transformation Success Manager plays a key role in delivering exceptional client experiences by building strong relationships and offering value-driven tax advisory and financial planning. This role ensures clients receive proactive, strategic guidance to achieve long-term financial success.

WAIT!

Get your estimated quote in just 2 minutes—no cost, no commitment.

WAIT!

Get your estimated quote in just 2 minutes—no cost, no commitment.

DON’T MISS OUT!

UPCOMING Webinar: Avoiding Expat Tax Pitfalls

Live Q&A with an expert. Limited spots only!

DON’T MISS OUT!

UPCOMING Webinar: Avoiding Expat Tax Pitfalls

Live Q&A with an expert. Limited spots only!