Form 8821: How to Fill Out and When to Use for Expats

When you’re abroad, it’s not always practical to handle your taxes on your own. You’re dealing with time zone differences, slow mail delivery, and complicated reporting rules. That’s why most expats turn to tax professionals for help. At some point, your tax pro may need access to your IRS records to check your past return or verify your income. That’s where Form 8821 comes in.

But what exactly does it do, and how is it different from Form 2848, the IRS Power of Attorney?

Let’s walk through everything you need to know about the form.

What Is IRS Form 8821 and When Do You Need It?

IRS Form 8821 is the IRS’s “Tax Information Authorization.” It gives someone, like your tax professional, permission to receive and review your tax records. However, unlike Form 2848, it doesn’t allow them to speak on your behalf in audits or disputes.

It’s perfect for situations where you want help but don’t need full representation.

Say you’re hiring a tax professional just to prepare your returns, or you want someone to review old transcripts, or to monitor IRS notices while you’re abroad. This form gives them access without signing away more than you have to.

For expats, this is a low-risk way to let your CPA stay in the loop. You’ll still be the one in charge, but you won’t miss a critical IRS letter or deadline just because you’re in another time zone.

Who Can You Authorize With IRS Form 8821?

You can authorize almost anyone to access your IRS tax information. A tax professional, accountant, enrolled agent, family member, or even your friend. The person or company you name on the form is called your “designee.”

You’re not limited to one person either. If you’re working with a tax firm, you can name both the firm and specific employees. This allows your entire tax team to access the documents they need without needing to request them each time.

Form 8821 also lets you specify exactly which tax years and tax forms your designee can view. You can limit access to just your 2022 and 2023 returns, or you can authorize them to access a broader range of years and forms.

One thing to remember is that Form 8821 doesn’t expire unless you put a specific end date or revoke it later. So, if you switch tax professionals, you’ll want to file a new form or submit a revocation.

When Should You Use Form 8821 Instead of Form 2848?

If you just need someone to access your IRS records, Form 8821 is usually the better and safer choice.

Form 2848 gives your representative full power to act on your behalf. That includes signing documents, making decisions, and speaking directly to the IRS. It’s often used for audits, collections, or legal representation.

Form 8821 is more limited by design. It only allows someone to view your tax data and receive IRS communications.

Here are common situations where Form 8821 makes more sense to file, especially if you’re living abroad:

- You’re working with a tax preparer to catch up on old returns or check for compliance issues.

- You want someone to pull transcripts, confirm what’s been filed, or spot missing forms.

- You’re expecting an IRS notice and don’t want it to get lost while you’re overseas.

- You’re hiring a new tax professional and want them to review your file first.

- You don’t want to give power of attorney unless it’s absolutely necessary.

What Do You Need to Fill Out IRS Form 8821?

Completing Form 8821 is relatively straightforward, but it’s helpful to know what to expect before you start. Here’s what you’ll need:

- Your name and U.S. taxpayer ID (like your SSN or ITIN)

- Your address abroad and phone number

- The name, address, and CAF number of the person or firm you’re authorizing

- The specific tax forms and years they can access (like Form 1040 for 2021–2023)

- Any limits you want to set, like “view only” access

- Your signature and the date

Make sure everything matches IRS records, especially your name and SSN. If there’s a mismatch, the IRS may reject the form without notifying you.

Your designee doesn’t have to sign the form. Once you send it in, they’ll receive access unless you’ve left something blank or incorrect.

How to Fill Out IRS Form 8821: Step-by-Step

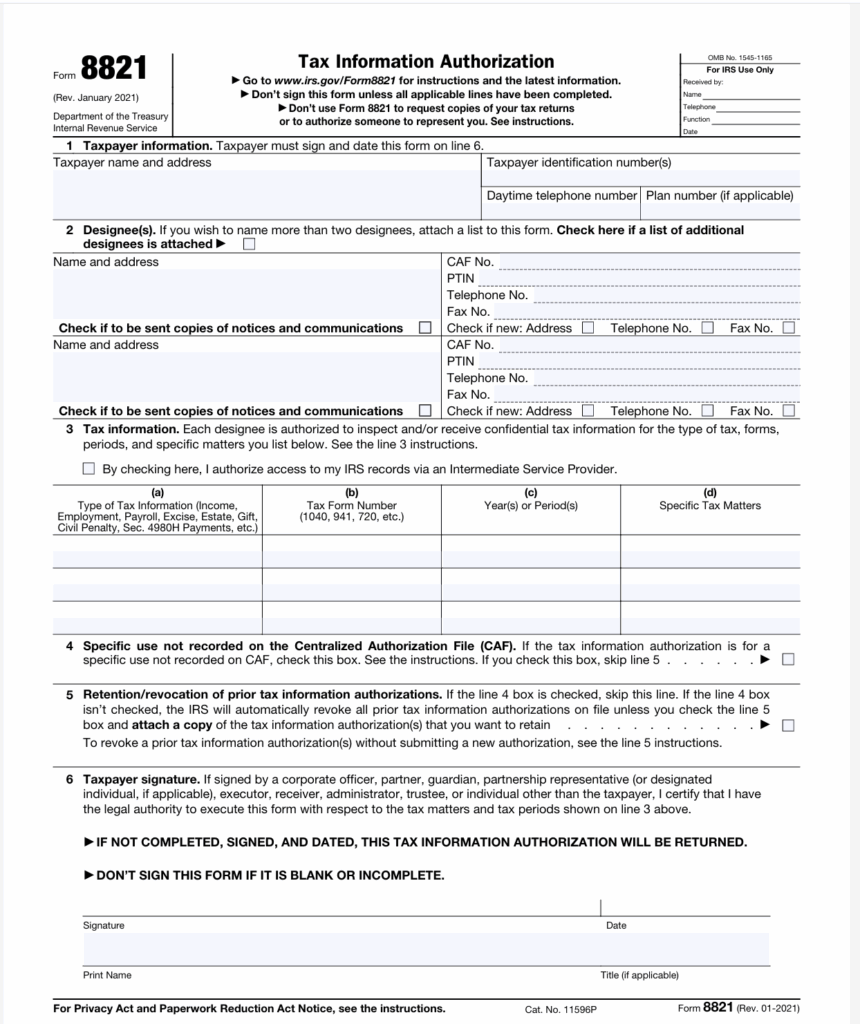

Form 8821 is a one-page form that’s easy to complete. Here’s how to fill it out, section by section:

1. Taxpayer information (Line 1)

Start with your name, address, and U.S. taxpayer ID (usually your SSN). If you’re filing this for a business, use the business name and EIN. Include your phone number, especially if you’re abroad.

2. Designee(s) (Line 2)

This is where you list the person or firm you’re authorizing to receive your IRS info. You’ll need their name, address, and if they have one, a CAF number or PTIN. You can list up to two people here. If you need more, attach a separate sheet.

Check the boxes to indicate whether the IRS should also send copies of IRS notices and letters directly to them.

3. Tax information (Line 3)

This section covers what tax matters your designee is allowed to view. List the type of tax (like “Income”), the form number (usually “1040”), the years (like “2021–2024”), and any specific matters (optional).

4. Special use (Line 4)

Skip this unless you’re requesting info not on the IRS’s CAF system.

5. Retention/revocation (Line 5)

If you want to keep previous Form 8821s active, check this box and attach a copy of what you want to keep. If you don’t check it, the IRS will revoke earlier authorizations.

6. Sign and date (Line 6)

You must sign and date the form to make it valid. If this is for a company or trust, the signer must have legal authority to act.

How to Submit Form 8821 from Abroad

If you’re working with a tax professional, they’ll most likely prepare and submit the form for you. However, if you’re going to file the form yourself, you have a few options for submitting Form 8821.

Option 1. Fax it to the IRS

This is the fastest option. The IRS accepts faxes of Form 8821. The IRS has a dedicated fax line just for international filers:

- 304-707-9785 (outside the U.S.)

- 855-772-3156 (if faxing from inside the U.S. or through an online fax service)

The numbers may change, so always check the current instructions for updates.

Option 2: Mail the form

If you prefer to mail your form, here’s the address to use if you’re living abroad:

Internal Revenue Service

International CAF Team

2970 Market Street

MS: 4-H14.123

Philadelphia, PA 19104

USA

If you’re mailing from outside the U.S., we recommend using a courier with tracking, like FedEx or DHL. Regular international mail can be slow and sometimes unreliable, so build in extra time.

Option 3: Submit Online (limited access)

Currently, the IRS does not offer a full digital submission process for Form 8821. However, authorized tax professionals can submit it via their IRS e-Services account.

Regardless of how you submit it, ensure that your Form 8821 is complete, signed, and dated. If it’s missing anything, the IRS won’t process it, and they won’t always tell you right away.

How to Revoke or Replace Form 8821

If you no longer want someone to access your IRS records, you’ll need to revoke the form. There are three easy ways to do this:

Option 1: Submit a New Form 8821

If you’re switching tax professionals or want to give someone else access, just file a new Form 8821. In Line 5, check the box to retain any prior authorizations you still want to keep and attach a copy of those old forms.

If you don’t check the box, the IRS will automatically cancel all earlier 8821s for the same tax matters.

Option 2: Revoke by Marking the Old Form

If you just want to cancel an existing authorization and aren’t replacing it, take a copy of the original Form 8821, write “REVOKE” across the top, and sign and date it. Then, fax or mail it to the same IRS address you’d normally use for sending the form.

Option 3: Send a Revocation Letter

You can also cancel the form by sending a signed letter to the IRS. This is helpful if you don’t have a copy of your old form. In your letter, include the following details:

- Your name and mailing address

- The name and address of the designee you want to remove

- The tax forms, matters, and periods covered (or write “all years/periods”)

- A clear statement that you’re revoking the authorization

- Your signature and the date

If your Form 8821 was for a special-use case (not recorded on CAF), send the letter to the IRS office handling your case. Otherwise, use the regular submission address or fax.

IRS Form 8821 Frequently Asked Questions

What is the purpose of IRS Form 8821?

Form 8821 gives someone permission to access your IRS records but not to speak or act on your behalf. It’s perfect if you just need a tax pro to request transcripts, view account info, or monitor IRS notices. Think of it as a “view only” pass for your tax data.

What is the difference between IRS Form 8821 and 2848?

Form 8821 lets someone access your IRS info, while Form 2848 gives them full legal authority to represent you. That means, with Form 2848, they can speak to the IRS, respond to notices, and even sign documents on your behalf. If you only want someone to look at your records, use Form 8821.

How long is IRS Form 8821 good for?

Form 8821 stays active until you revoke it or set an expiration date. If you leave that part blank, the IRS will keep the authorization on file indefinitely. That’s why it’s a good idea to review and update it when your tax situation changes.

Can Form 8821 be electronically signed?

If you’re submitting Form 8821 online through an IRS-approved platform, electronic signatures are allowed. That includes typing your name, using a stylus, or uploading a scanned signature. Just make sure it’s done through secure software. But if you’re faxing or mailing the form, the IRS still requires a traditional handwritten signature in ink (no e-signatures allowed).

How do I submit Form 8821 from overseas?

The fastest way is to fax it to the IRS using their international fax line. You can also mail it, but international shipping takes longer. If you’re working with a U.S.-based tax pro, they may be able to submit it through the IRS e-Services platform for you.

Let Your Tax Pro Help

Filing Form 8821 can make a big difference, especially when you’re living abroad. It allows your tax professional to access the information they need to help you stay on top of notices, payments, and IRS communication without giving them full control over your tax matters.

Still, it’s important to only share access with someone you trust. Your IRS records contain sensitive information, and while Form 8821 doesn’t give anyone the power to act on your behalf, it does open the door to your tax data.

So before you sign anything, make sure you’re working with a reputable tax professional who respects your privacy and works in your best interest.

Need help getting started? Book a free 30-minute consultation using the link below, and let’s talk through your options.