How to File Form 5471 for U.S. Expats with Foreign Corporations

If you are a U.S. citizen or resident involved with a foreign corporation, you may need to file IRS Form 5471, even if the corporation has no U.S. source income or establishment. This form requires U.S. officers, directors, or shareholders in foreign corporations to report the corporation’s activities and comply with U.S. tax laws.

Form 5471 is an information return that ensures the U.S. government can tax foreign profits through Subpart F rules even before they are distributed as dividends. This form is complex and confusing, even for seasoned tax professionals, due to its multiple reporting purposes and infrequent use by U.S.-based taxpayers.

Fortunately, Tax Samaritan is one of the few specialty tax preparation firms with real expertise in this field and can assist you in accurately preparing and filing Form 5471.

Learn the basics, including who needs to file, the filing deadlines, penalties for non-compliance, and the form’s purpose here.

Who Must File Form 5471

According to the Form Instructions, Form 5471 currently has five Categories of Filers based on the corporation’s ownership and control.

All U.S. persons who meet the criteria for one or more categories must file a Form 5471. Unfortunately, to complicate things even further for the taxpayer, ownership is not limited to direct ownership and can be based on indirect and constructive ownership (i.e. attribution of ownership of other entities controlled by the taxpayer or certain family members). Some exceptions may apply in the case of attribution from a non-resident alien.

Category 1 Filer

This category includes a U.S. shareholder of a foreign corporation that is a section 965 specified foreign corporation (SFC) at any time during any tax year of the foreign corporation, and who owned that stock on the last day in that year on which it was an SFC.

U.S. person. For purposes of Category 1, 2, and Category 3, a U.S. person is:

- A citizen or resident of the United States,

- A domestic partnership,

- A domestic corporation, and

- An estate or trust that is not a foreign estate or trust, defined in section 7701(a)(31).

U.S. shareholder. For purposes of Category 1, a U.S. shareholder is a U.S. person who owns (directly, indirectly, or constructively, within the meaning of sections 958(a) and (b)):

- 10% or more of the total combined voting power of all classes of voting stock of an SFC, or

- For tax years beginning after December 31, 2017, 10% or more of the total combined voting power or value of shares of all classes of stock of an SFC.

SFC. For purposes of Category 1, an SFC (as defined in section 965) is:

- A Controlled Foreign Corporation (CFC), or

- Any foreign corporation with respect to which one or more domestic corporations is a U.S. shareholder.

However, a passive foreign investment company (PFIC) that is not a CFC is not considered an SFC. U.S. shareholders who fall into this category must continue to file all required information as long as the SFC has accumulated earnings and profits (E&P) related to section 965 reportable on Schedule J, or previously taxed E&P related to section 965 reportable on Schedule P.

Category 1a Filer

A Category 1a filer is a Category 1 filer that is not classified as either a Category 1b or Category 1c filer.

Category 1b Filer

An unrelated U.S. shareholder of a foreign-controlled section 965 SFC. They own stock in the foreign-controlled section 965 SFC and are not related to it. These shareholders extend relief similar to Category 5 filers.

Category 1c Filer

A related constructive U.S. shareholder of a foreign-controlled section 965 SFC. They do not directly own stock but are related to the foreign-controlled section 965 SFC.

TIP: The IRS has established an exception for foreign corporations that qualify as Passive Foreign Investment Companies (PFICs) but not as Controlled Foreign Corporations (CFCs) to a particular shareholder. If a foreign PFIC does not meet the criteria as a CFC, it does not qualify as a Section 965 specified foreign corporation.

Category 2 Filer

This includes a U.S. citizen or resident who is an officer or director of a foreign corporation in which a U.S. person (defined below) has acquired (in one or more transactions):

- A stock which meets the 10% stock ownership requirement (described below) with respect to the foreign corporation or

- An additional 10% or more (in value or voting power) of the outstanding stock of the foreign corporation.

A U.S. person has acquired stock in a foreign corporation when that person has an unqualified right to receive the stock, even though the stock is not issued.

Stock ownership requirement. For purposes of Category 2 and Category 3, the stock ownership threshold is met if a U.S. person owns:

- 10% or more of the total value of the foreign corporation’s stock or

- 10% or more of the total combined voting power of all classes of stock with voting rights.

Category 3 Filer

This category includes:

- A U.S. person who acquires stock in a foreign corporation which, when added to any stock owned on the date of acquisition, meets the 10% stock ownership requirement with respect to the foreign corporation;

- A U.S. person who acquires stock which, without regard to stock already owned on the date of acquisition, meets the 10% stock ownership requirement with respect to the foreign corporation;

- A person who is treated as a U.S. shareholder under section 953(c) with respect to the foreign corporation;

- A person who becomes a U.S. person while meeting the 10% stock ownership requirement with respect to the foreign corporation or

- A U.S. person who disposes of sufficient stock in the foreign corporation to reduce his or her interest to less than the stock ownership requirement.

Category 4 Filer

This includes a U.S. person who had control (defined below) of a foreign corporation for an uninterrupted period of at least 30 days during the foreign corporation’s annual accounting period.

U.S. person. For purposes of Category 4, a U.S. person is:

- A citizen or resident of the United States;

- A nonresident alien for whom an election is in effect under section 6013(g) to be treated as a resident of the United States;

- An individual for whom an election is in effect under section 6013(h), relating to nonresident aliens who become residents of the United States during the tax year and are married at the close of the tax year to a citizen or resident of the United States;

- A domestic partnership;

- A domestic corporation; and

- An estate or trust that is not a foreign estate or trust defined in section 7701(a)(31).

Control. A U.S. person has control of a foreign corporation if, at any time during that person’s tax year, it owns stock possessing:

- More than 50% of the total combined voting power of all classes of stock of the foreign corporation entitled to vote or

- More than 50% of the total value of shares of all classes of stock of the foreign corporation.

A person in control of a corporation that, in turn, owns more than 50% of the combined voting power, or the value, of all classes of stock of another corporation is also treated as being in control of such other corporation.

Category 5 Filer

This includes a U.S. shareholder who owns stock in a foreign corporation that is a Controlled Foreign Corporation (CFC) for an uninterrupted period of 30 days or more during any tax year of the foreign corporation, and who owned that stock on the last day of that year.

U.S. shareholder. For purposes of Category 5, a U.S. shareholder is a U.S. person who:

- Owns (directly, indirectly, or constructively, within the meaning of sections 958(a) and (b)) 10% or more of the total combined voting power of all classes of voting stock of a CFC or

- Owns (either directly or indirectly, within the meaning of section 958(a)) any stock of a CFC (as defined in sections 953(c)(1)(B) and 957(b)) that is also a captive insurance company.

U.S. person. For purposes of Category 5, a U.S. person is:

- A citizen or resident of the United States,

- A domestic partnership,

- A domestic corporation, and

- An estate or trust that is not a foreign estate or trust defined in section 7701(a)(31).

CFC. A CFC is a foreign corporation that has U.S. shareholders that own (directly, indirectly, or constructively, within the meaning of sections 958(a) and (b)) on any day of the tax year of the foreign corporation, more than 50% of:

- The total combined voting power of all classes of its voting stock or

- The total value of the stock of the corporation.

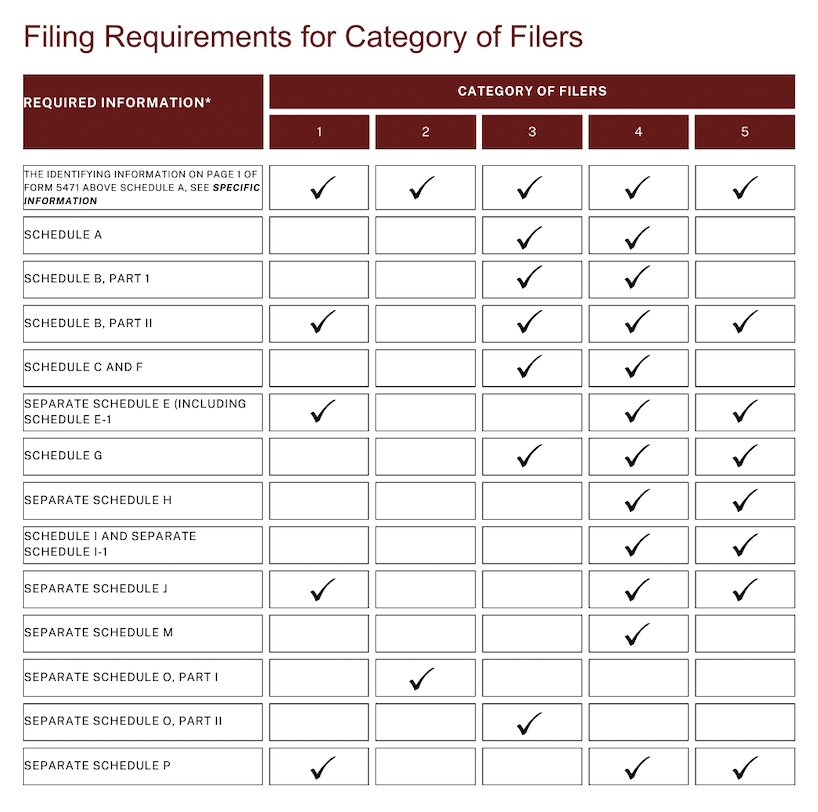

Form 5471 Filing Requirements for Categories of Filers

The Filing Requirements for Categories of Filers are illustrated in the chart below:

The above chart identifies the schedules the filer must report based on their “Category of Filer”.

The required information may be as minimal as the identification of the US shareholder and the name and address of the foreign corporation — or as extensive as a balance sheet and income statement converted from multiple foreign currencies into US dollars and also transformed into the GAAP method of accounting.

Unlike domestic corporations that report their taxes using Form 1120 or 1120s, Form 5471 is more extensive and requires foreign corporations to report and evaluate other essential issues such as subpart F income, transfer pricing, and foreign tax credits. Please see our article on Subpart F Income to learn more about this area.

The amount of work required to prepare Form 5471 can be extensive and also very time-consuming.

When determining if Form 5471 is required to be filed, remember that a foreign limited liability company (LLC) will be treated as a foreign corporation if an election has not been made to classify the entity as a foreign disregarded entity or a foreign partnership (which in itself would have to file a form similar to 5471, the Form 8865). Additionally, according to the IRS, a “foreign corporation” also includes an “International Business Company (IBC)’’ in which a U.S. person has partial ownership.

TIP: If you are the sole owner of a foreign corporation and live in the U.S., you can potentially simplify your tax obligations by electing to treat the corporation as a Foreign Disregarded Entity. This election can reduce your filing complexity and streamline your tax reporting. For personalized guidance and to ensure this strategy fits your situation, consult a tax expert.

What if my foreign corporation had no activity during the year?

Unfortunately, no exception will exclude you from filing Form 5471 if you fall into one of the abovementioned categories. The IRS has not set any income or asset thresholds for filing Form 5471. A dormant corporation filing procedure may be available if you meet the criteria and file a Form 5471 with limited information for the dormant entity.

Substantial Compliance or Substantial Penalty

Penalties under sections 6038, 6038A, and 6046 may apply if the filer does not submit a substantially complete return. The IRS has not included a definition of “substantial compliance” in the instructions of Form 5471 or the Code, making it rather difficult for taxpayers to determine if their filing will comply.

Luckily, the IRS has given some guidance on the meaning of substantially complete with reference to international information return penalties. Specific obvious errors on Form 5471 will cause the return to dramatically be incomplete:

- Omitting the Entity Identification Number (EIN) or Reference ID

- Failure to complete the category of filer section correctly (Item B)

- Omitting the name and address of the foreign corporation

- Failure to complete the total percentage of stock owned correctly (Item C)

- Failure to submit any required additional schedule (e.g. schedules J, M, or O)

Beyond these obvious errors, the IRS may deem a return substantially incomplete based on various factors, such as:

- Balance sheet and income statements not being in accordance with U.S. GAAP

- The extent of erroneous transactions reported

- Significance of under- or over-reporting

- Not providing required amounts in both functional and U.S. currencies

Consequently, taxpayers must ensure that Form 5471 submissions are as complete and accurate as possible. Otherwise, they could potentially face significant penalties.

Need US expat tax advice? Book a consultation now!

Impact of the Tax Cuts and Jobs Act of 2017 on Form 5471

The Tax Cuts and Jobs Act (TCJA), signed into law on December 22, 2017, brought significant changes to tax laws, significantly affecting shareholders of foreign corporations. One of the fundamental changes was the creation of IRS Form 8992 and revisions to Form 5471. The changes drastically altered the operation and reporting requirements for controlled foreign corporations (CFCs).

1. Repatriation of Accumulated Earnings

One significant change of the TCJA is the mandatory repatriation of accumulated earnings held in certain specified foreign corporations, effective for the last taxable year before January 1, 2018. This applies to any controlled foreign corporation or a foreign corporation in which a U.S. shareholder owns 10% or more of the voting stock. U.S. shareholders must include their pro rata share of accumulated post-1986 foreign earnings on their tax return, subject to a tax rate of 8% or 15.5%, depending on how the earnings are retained. Cash and cash equivalents are taxed at the higher 15.5% rate, while other undistributed earnings are taxed at 8%.

2. Introduction of Global Intangible Low-Taxed Income (GILTI)

The TCJA also introduced new rules under Section 951A of the Internal Revenue Code (IRC) that require the inclusion of Global Intangible Low-Taxed Income (GILTI) for CFCs. GILTI is calculated as the excess of a shareholder’s net tested income from a CFC over the net deemed tangible income return for the year. Net tested income generally includes the CFC’s gross income, excluding Subpart F income, foreign oil and gas extraction income, and income already taxed as effectively connected income in the U.S. Net deemed tangible income is the excess of 10% of the aggregate of the shareholder’s pro rata share of the qualified business asset investment of each CFC, over the interest expense accounted for in determining the shareholder’s net CFC tested income. To learn more about this, refer to our detailed article on Form 8992 and the GILTI Calculation.

3. Changes to Subpart F Income Rules

The act modified Subpart F income rules for CFCs. It expanded the definition of a U.S. shareholder to include individuals owning 10% or more of the total value of the foreign corporation’s stock or voting stock. Additionally, the legislation eliminated the requirement that a foreign corporation must be a CFC for at least 30 consecutive days for its U.S. shareholders to be subject to Subpart F income. Those who have structured their foreign company so that the foreign corporation is owned by a U.S. corporation can benefit from the new legislation. This is mainly because the bill favors larger multinational corporations and encourages them to repatriate foreign earnings. For most taxpayers, their foreign corporation is owned by themselves or others.

What if I do not have Subpart F Income?

Many taxpayers may erroneously conclude that Form 5471 is not required if they are not required to report Subpart F Income. Form 5471 is still required whether or not the foreign corporation had Subpart F income. Generally, certain exceptions may exempt you from filing Form 5471 if you fall into one of the filing categories.

Installment Election

The law includes a provision allowing the taxpayer to pay the liability in eight installments rather than in one lump sum for those individuals. The installment payments can be broken down as follows:

- 8% of the net tax liability in the case of each of the first five such installments

- 15%of the net tax liability in the case of the sixth such installment

- 20% of the net tax liability in the case of the seventh such installment

- 25% of the net tax liability in the case of the eighth such installment

If electing to pay the liability in installments, the taxpayer must make the first installment payment by the due date of their return without considering any extensions of time for filing the return. Each subsequent installment is due on the following year’s tax return date. Earnings that were already subject to tax can be distributed tax-free in the future.

What Happens if You Don’t File Form 5471 on Time?

It is essential to be aware of the Form 5471 filing requirements and make sure you properly assess whether each particular entity needs to file the form. The stakes are very high as failure to timely file Form 5471 can result in penalties of up to $10,000 for each year. These penalties can apply even if no tax is due. The penalty can increase if you fail to file the form after the IRS issues a failure to file notification. The penalty then increases to $10,000 monthly up to a maximum of $50,000.

An incomplete 5471 is also deemed unfiled, and the same penalties apply. Just one small mistake can cost you $10,000! Also, since Form 5471 is part of your income tax return filing, the filing of your return would also be deemed unfiled.

Criminal Penalties

Also, criminal penalties may apply for failure to file the requisite information. If you are directly or indirectly involved in a foreign corporation in any of the ways discussed above, we advise you to contact us to determine if you have any filing obligations.

It was rare in the past to receive a response about a Form 5471 filed late. However, we are hearing more and more about taxpayers who have self-prepared their Form 5471 being assessed an automatic $10,000 penalty for each year filed late or incomplete.

Last but not least, if you don’t file the form, the IRS will consider Form 1040 “non-filed” and open it for audit and penalties—a dream come true for tax collectors.

Form 5471 Due Date

The shareholder must file Form 5471 with and by the due date of their income tax return (including extensions). For most entities, that would be March 15th or April 15th (including extensions). For most individuals, that would be April 15th or the extended due date.

Corporate-Owned Foreign Bank Accounts

Owners of foreign corporations must meet extra reporting requirements due to their corporations holding foreign financial accounts. The Report of Foreign Bank and Financial Accounts (FBAR) requires taxpayers to report a financial interest in or signature authority over a foreign financial account, including a bank account, brokerage account, mutual fund, trust, or other type of foreign financial account. This includes accounts owned by the foreign corporation, which the taxpayer has control over. Consider these financial accounts when determining if the taxpayer needs to file an FBAR. U.S. persons must file the FBAR if their total foreign financial accounts exceed $10,000 at any time during the calendar year.

Form 5471 Filing Instructions

Form 5471 is a complex document that can take over 32 hours to complete.

It requires you to provide the IRS with detailed financial information about the foreign corporation. This includes its income statement, balance sheet, loans, operations, and details about other shareholders. You also need to report dividends and payments made to shareholders, officers, and directors.

You must present the financial data using U.S. generally accepted accounting principles (U.S. GAAP), which often differ from those used in foreign financial statements. You may need to convert the foreign financial statements into the required format.

If you own a foreign corporation and haven’t filed Form 5471, you should start immediately to avoid the $10,000 penalty. The IRS is increasing its efforts to gather information on U.S. citizens’ overseas finances through FATCA and other methods, and many U.S.-Foreign Country tax treaties facilitate the exchange of tax information.

TIP: If you own multiple foreign corporations, remember that each requires a separate Form 5471. However, if several individuals are reporting for the same corporation, a joint filing might be possible

Options to Get Into Compliance

Owners of foreign corporations who must file Form 5471 should be quick to comply. Depending on their circumstances, taxpayers have a few options available.

1. Streamlined Filing Compliance Procedure

It’s a popular option for taxpayers to resolve their tax obligations and file overdue or amended returns. It’s available to both U.S. residents and those living abroad. To comply, taxpayers must file the last three years of overdue or amended returns and six years of overdue or amended FBAR reports. To qualify, you need to meet these criteria:

- Certify that your conduct was not willful.

- The IRS has not officially examined your returns for any year.

- You must pay any penalties assessed if you’ve previously filed overdue or amended returns.

- You need a valid Taxpayer Identification Number.

The IRS will process returns submitted through this program like any other IRS return. They won’t be automatically audited but may be selected for audit through regular processes. The accuracy and completeness of your submissions may be verified against information from banks, financial advisors, and other sources.

2. Statement of Reasonable Cause

If you don’t need to use the Streamlined Filing Compliance Procedures but you still need to file delinquent or amended tax returns for missing international information forms (e.g., 5471, 3520, 3520A), you can use the Delinquent International Information Return Submission Procedure with a Statement of Reasonable Cause. To qualify, you must:

- Have a reasonable cause for not filing

- Not be under IRS examination or investigation

- Not be in contact with the IRS about the missing returns

When you submit your returns, attach a Statement of Reasonable Cause. In this statement, you must certify that no entity engaged in tax evasion. You must also provide all relevant facts that establish reasonable cause. The IRS won’t automatically audit these returns but may choose them for audit through their standard processes.

What People Ask About The Form 5471

Below are common questions and answers that people ask about the 5471 form.

What Is The Purpose of The Form 5471?

Form 5471 is required for certain U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. The form and schedules satisfy the reporting requirements of sections 6038 and 6046 and the related regulations.

How Do I File The Form 5471?

Form 5471 is an attachment to your individual income tax return (aka “the Form 1040”). It also attaches to a domestic partnership, corporation, or exempt organization return if applicable.

You must file both the tax return and the Form 5471 by the due date for that return, including extensions.

Do I Have To File Form 5471 Annually?

When a U.S. person must file an IRS Form 5471 (an information return) under IRC 6046(a), they attach it to an individual income tax return, a partnership return, a corporation return, an estate return, or a trust return. The Category of Filer(s) will determine the Form 5471 filing requirements’ frequency and timing. For example, a Category 5 Filer must file IRS Form 5471 annually.

What Is A CFC?

A CFC is a controlled foreign corporation. Its rules exist to limit the deferral of tax by using foreign entities. The laws apply only to the income of an entity that is not currently taxable to its owners.

What Is Subpart F Income?

Subpart F income is a provision that aims to limit the deferral of U.S. income taxes on foreign corporations’ earnings. It applies specifically to CFS, in which U.S. persons own more than 50% of the stock by vote or value.

Subpart F income includes passive income such as dividends, interest, rent, and royalties. The purpose of this regulation is to prevent foreign corporations from deferring U.S. tax on income typically unrelated to their business activities in their country of incorporation. Rather than taxing the foreign corporation directly, Subpart F requires U.S. shareholders to include their share of this income on their tax returns. The rules governing Subpart F are complex, with numerous exceptions and special provisions that require careful attention.

What Is Section 965?

Section 965 requires U.S. shareholders to pay a transition tax on the untaxed foreign earnings of certain specified foreign corporations as if they repatriate those earnings to the United States. This tax, also known as the Mandatory Repatriation Tax (MRT), was introduced as part of the TCJA 2017. It applies to the accumulated post-1986 foreign earnings that remain untaxed.

Recently, the Supreme Court upheld the constitutionality of the Mandatory Repatriation Tax. This ruling affirms Congress’s authority to tax the undistributed earnings of CFCs by attributing those earnings to U.S. shareholders. The Court emphasized that the foreign corporation considers the income tax under Section 965 realized, even if not distributed to the shareholders. This approach aligns with long-established tax principles, such as those governing Subpart F and S corporation taxation, which courts have upheld as constitutional.

The ruling has significant implications for U.S. taxpayers with interests in foreign corporations. It reinforces the IRS’s ability to levy taxes on undistributed foreign earnings. It emphasizes the need to understand and comply with Section 965 to avoid tax liabilities and penalties.

Wrapping It Up

Filing Form 5471 can be incredibly complex and time-consuming, often requiring detailed financial information and adherence to U.S. GAAP standards. If this sounds overwhelming, you’re not alone. Many taxpayers struggle with these requirements, but you don’t have to navigate it by yourself.

Tax Samaritan specializes in helping U.S. taxpayers involved with foreign corporations comply with these stringent filing requirements. Our expert team can guide you through every step of the process, ensuring accuracy and helping you avoid costly penalties.

Tax Samaritan aims to provide our clients with the best counsel, advocacy, and personal service. We are not only expat tax preparation and representation experts but strive to become valued business partners. Tax Samaritan commits to understanding our client’s unique needs. Every tax situation requires a personal approach to providing realistic and practical solutions.

All About Randall Brody

Randall is the Founder of Tax Samaritan, a boutique firm specializing in the preparation of taxes and the resolution of tax problems for Americans living abroad, as well as the other unique tax issues that apply to taxpayers. Here, they help taxpayers save money on their tax returns.