6 Important Things You Need to Know About Foreign Tax Credit Carryover

Staying on top of your taxes is crucial, especially if you’re an expat. Aside from paying taxes in the foreign country where you work, you also have to consider your U.S. tax dues. Fortunately, as you learn more about Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credit (FTC), you have more options to hack your tax billables and pay fewer taxes legally. So read on to IRS foreign tax credit carryover and how you can use it to your advantage.

6 Answers to FAQs About Foreign Tax Credit Carryover

1. How can I calculate my foreign tax credit?

Calculating your foreign tax credit begins by grouping your income into passive and general income. Passive income is regular earnings from sources independent of a contractor or employer. Investment income, such as interest, rent, and dividends, fall under the passive income category.

On the other hand, your general income includes your salary, all foreign pay types, and other earned income not classified under passive income fall. Once you’ve distinguished all your income based on their respective categories, you can calculate the allowable credit for each income category.

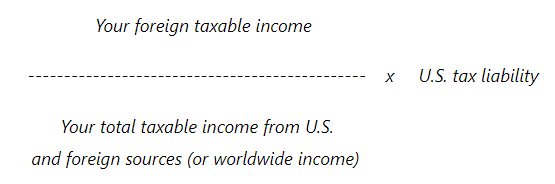

Here’s the formula for getting your tax credit limit. Multiply your total U.S. income tax liability by the taxable foreign income percentage to your total worldwide income.

Equation:

To illustrate:

- Foreign Taxable Income = 35,000

- Worldwide Taxable income = $200,000

- U.S. Tax Liability = 60,000

= (35,000 / 200,000) x 60,000 = 10,500

= $10,500 foreign tax credit limit

2. How does one accumulate foreign tax credit carryovers?

Paying high tax rates in a foreign country can incur foreign tax credit carryovers. However, if you return to the U.S. with carryover credit, you will be unable to use the credit against your local U.S. income source, as it only applies to foreign income.

Suppose you’re determined to exhaust all your carryover credit. In that case, it’s best to relocate to a country that imposes lower taxes.

3. What happens if my credits exceed the IRS limit?

The IRS imposes a limit on claimable credits for a tax year. Thus, if your qualified foreign tax credit exceeds the IRS limit, you may be allowed to carry it back or over. However, you will lose the credit if you fail to use it within the allowable period.

Additionally, deducting qualified foreign taxes (via FEIE) and claiming credit (via FTC) in the same tax year will prevent you from using a carryover or a carryback. This is because you can only do one process within the same tax year.

4. How does the IRS apply foreign tax credits?

Expats with a foreign tax credit carryover from a previous tax year and foreign credit in the current year must first apply the current year’s tax credit. Furthermore, exhausting all your current year credit will allow you to utilize the foreign tax credit carryover.

5. How long can I use my foreign tax credit carryover?

If you cannot claim the total amount of paid or accrued qualified foreign income taxes, then you will be granted one year for a carryback and 10 years to carry over.

The unused foreign tax is the excess amount from paid or accrued taxes. Here is a foreign tax credit carryover example to give you a better idea.

| Expat X’s Tax Credit Limit | Tax Paid in the Foreign Country | Unused Foreign Tax (+) / Excess Limit (−) | |

| 2018 | $400 | $200 | -200 |

| 2019 | $500 | $800 | +300 |

As you can see in the sample table, in 2019, Expat X had an unused foreign tax of $300 to carry over to other years. Additionally, Expat X initially paid the unused foreign tax in 2018 – the first preceding tax year – up to the excess limit of $200 for that year. As such, Expat X could then carry over $100 in unused tax.

6. What if I continue to get carryovers on my foreign income?

Accumulating tax credit carryovers on your foreign income will help relieve you of a double tax burden, since the U.S. entitles expats to a tax credit for foreign taxes one accrues or pays off. Resident aliens, as well as U.S. citizens who paid foreign income tax and are subject to U.S. tax on that same income, can claim the foreign tax credit.

Don’t Be Foreign to Taxes

U.S expats have a lot on their plate, considering they live in a foreign country that imposes tax rules and processes different from the U.S. Thus, it is understandable that some may not be aware or knowledgeable of the foreign tax credit carryover process. However, knowing these processes is crucial to uphold your duty as a responsible U.S. taxpayer.

If you’re searching for a provider of reliable tax resolution services, look no further than Tax Samaritan. Helping expats save money through wise tax-planning decisions since 1997, Tax Samaritan offers the best-in-class service. Contact us today and get a free tax quote!

All About Randall Brody

Randall is the Founder of Tax Samaritan, a boutique firm specializing in the preparation of taxes and the resolution of tax problems for Americans living abroad, as well as the other unique tax issues that apply to taxpayers. Here, they help taxpayers save money on their tax returns.