Foreign Account Tax Compliance Act (FATCA) Explained

Since its enactment in 2010, the Foreign Account Tax Compliance Act (FATCA) has changed how U.S. citizens living abroad file their tax returns. While its intended purpose was to uncover tax evaders hiding wealth overseas, the average person may find it challenging to properly understand these new requirements and put themselves at risk of harsh penalties.

This article will discuss FATCA, what it means, how it affects doing taxes for expats, and how you can stay compliant with FATCA requirements.

What is FATCA?

FATCA, or the Foreign Account Tax Compliance Act, is a tax law that mandates U.S. citizens—both native and expats—to file their annual reports on any foreign account holdings and assets exceeding certain thresholds. It also requires foreign financial institutions and some non-financial entities to report on foreign assets held by U.S. account holders to the Internal Revenue Services (IRS).

Enacted in 2010 in line with the Hiring Incentives to Restore Employment (HIRE) Act, FATCA was designed to recover tax losses due to undeclared offshore wealth and assets. This manifested in the legislation’s new self-reporting requirements and heavy penalties for those who fail to comply with the reporting rules.

5 Things You Should Know About FATCA

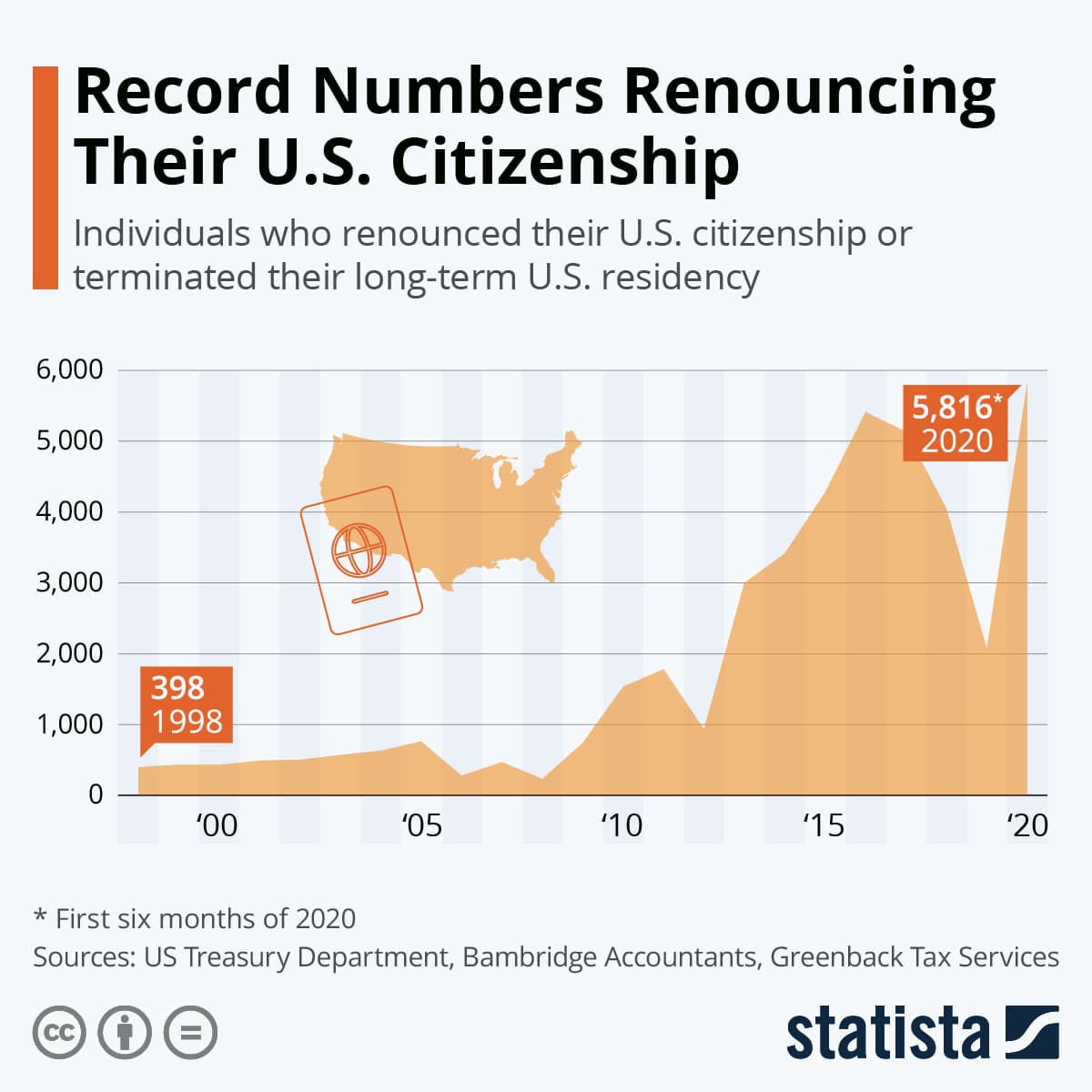

1. FATCA has led a record number of Americans to renounce their U.S. citizenship.

Under FATCA, U.S. citizens anywhere in the world are required to file their taxes and declare their foreign assets, or else face harsh penalties. Since 2012, there has been a steady increase in expatriation by individuals struggling to keep up with these requirements.

While renouncing your citizenship may seem like a simple solution to avoid FATCA, it is actually more complicated than it appears. The process for renouncing one’s citizenship is very long and can incur even more hefty fees—on top of the $2,350 cost of renouncing. Working with Tax Samaritan can help you avoid “double taxes” without undergoing drastic and costly measures.

2. FATCA operates similarly to FBAR, but they aren’t the same.

The Foreign Bank Account Report (FBAR) is another tool that the U.S. government uses to ensure tax compliance from its citizens. The key difference is that FBAR specifically covers foreign bank accounts with balances of $10,000 or higher, regardless of how long the account retained that balance.

Meanwhile, FATCA covers a wider range of foreign assets beyond a bank account. FATCA has higher value thresholds than FBAR. However, you will still need to file FBAR alongside FATCA if your foreign account balance falls over the given threshold.

3. FATCA requirements are extensive and thorough.

FATCA covers assets valued at $200,000 on the last day of the tax year or $300,000 at any point during the year (for single taxpayers living abroad) or $400,000 on the last day of the tax year and $600,000 at any point during the year (for married taxpayers living abroad).

According to the IRS, these foreign assets include:

- Stockholdings

- Partnership interests

- Financial accounts

- Mutual funds

- Issued life insurance

- Hedge funds

- Real estate held through a foreign entity*

*While the real estate does not need to be reported, the foreign entity itself is a specified foreign financial asset, and its maximum value includes the value of the real estate

If you are unsure whether or not certain assets are included when filing for FATCA, consult with the tax professionals at Tax Samaritan.

4. FATCA is globally enacted but can have unique regional agreements.

The requirements for FATCA are enacted globally, meaning its regulations and conditions apply anywhere in the world, though it may slightly differ depending on the country you are in.

Certain countries have signed an inter-governmental agreement (IGA) with the U.S. that afforded them more flexibility with tax deadlines, simplified due diligence, and certain clarifications regarding country-specific provisions. Countries with enacted IGAs may also have more uniform procedures.

According to the U.S. Department of the Treasury, there are two models of IGA agreements: Model 1 and Model 2. The difference between them is the exchange of information, with Model 1 allowing for a reciprocal or non-reciprocal basis, while Model 2 is only on a non-reciprocal basis.

5. FATCA penalties for non-compliance are heavy.

According to the IRS, failure to comply with FATCA can result in a $10,000 penalty, which can go up to $50,000 for continued failure after IRS notification. There is also a 40% penalty on understatement of tax attributable to non-disclosed assets.

If you were previously unaware of the reporting requirements under FATCA, there are several options available for expats. The most common is to file under the Streamlined Filing Procedures. This IRS program allows people to catch up with their filing obligations without incurring penalties, provided that the lack of filing wasn’t willful or purposeful.

FATCA Compliance for Hassle-Free Tax Filing

Like it or not, FATCA is here to stay. As long as you know which assets need to be reported and the possible IGA available in the country you’re in, you’ve got nothing to worry about. For a hassle-free tax season, Tax Samaritan offers top-notch expat tax services that can ensure you are FATCA-compliant.

All About Randall Brody

Randall is the Founder of Tax Samaritan, a boutique firm specializing in the preparation of taxes and the resolution of tax problems for Americans living abroad, as well as the other unique tax issues that apply to taxpayers. Here, they help taxpayers save money on their tax returns.