Form 1099-MISC: Urgent Reasons You Need To File

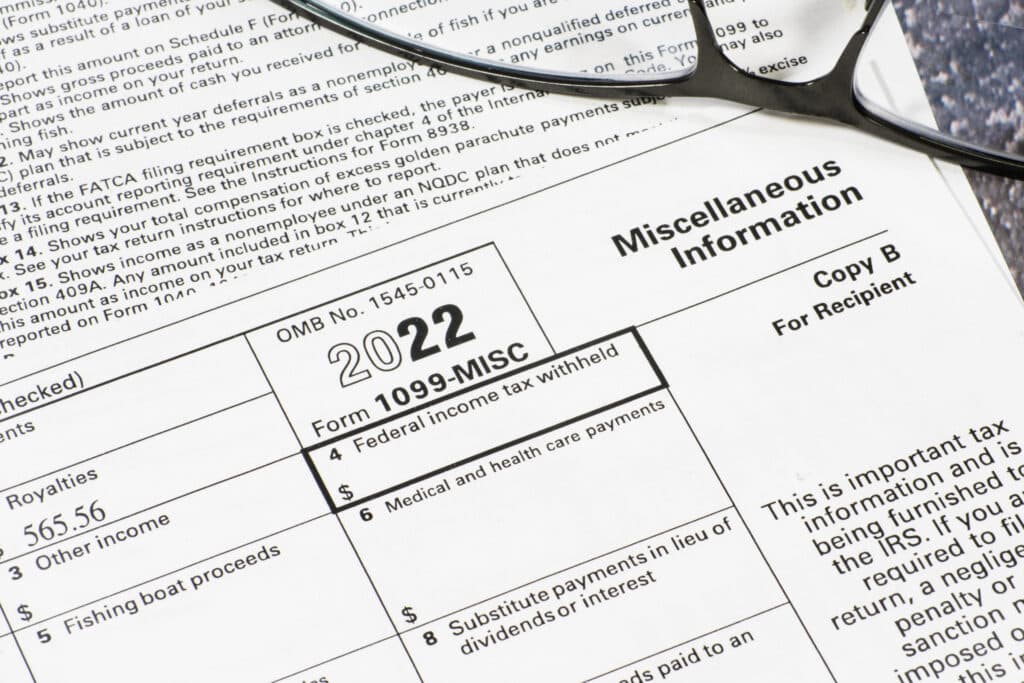

Form 1099-MISC, also known as Miscellaneous Information, is an IRS form used for specific types of miscellaneous income paid to individuals or entities. This form ensures that various sources of income, from rent and royalties to payments to attorneys and healthcare, are properly documented and reported to both the recipient and the IRS. In the past, it also included nonemployee compensation for independent contractors, freelancers, sole proprietors, and self-employed individuals, which is now reported on Form 1099-NEC.

Payments Reported on Form 1099-MISC

Form 1099-MISC is typically completed and issued by businesses or individuals who have made payments above certain thresholds to others. These payments include:

- Royalties (Box 2): Payments exceeding $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

- Rent (Box 1): Payments totaling at least $600 for rent.

- Prizes and Awards (Box 3): Payments of $600 or more for prizes and awards, including those from game shows.

- Other Income Payments (Box 3): Miscellaneous payments of $600 or more, including those from notional principal contracts, fishing boat proceeds, medical and health care payments, crop insurance proceeds, and payments to attorneys.

- Fishing Boat Proceeds (Box 5): Income from the sale of fish or other aquatic life for resale.

- Payments to Attorneys (Box 10): Payments made to attorneys, subject to specific reporting requirements.

Additionally, Form 1099-MISC may be used to report direct sales of consumer products of $5,000 or more for resale, outside of permanent retail establishments.

Who Files Form 1099-MISC?

Form 1099-MISC is filed by those who make payments to others during their trade or business. It’s essential to understand that this form is not used for payments made to employees or nonemployee compensation. Instead, it’s for reporting payments to various individuals or entities, such as landlords, contractors, attorneys, and others.

Businesses and individuals who pay at least $10 in royalties or $600 or more in other types of miscellaneous income during a calendar year must file Form 1099-MISC. Additionally, if federal income tax is withheld under backup withholding rules, the payer must provide the form to the recipient, regardless of the withheld amount.

Reporting and Filing Deadlines

The recipient of a Form 1099-MISC should receive it by February 1st, and you must file it with the IRS by February 28th if filing on paper, or by March 31st if filing electronically. The recipient must then report the income received on their tax return.

Filling Out Form 1099-MISC

Completing Form 1099-MISC can be straightforward with the right guidance. The form is available on the IRS website, and it consists of several copies for various purposes, including:

- Copy A: For IRS use only.

- Copy 1: Sent to the recipient’s state tax department.

- Copy B: Sent to the recipient.

- Copy 2: Sent to the recipient for their state tax return.

- Copy C: Retained by the payer for record keeping.

When completing the form, you’ll provide personal information, including your name, address, and tax identification number, as well as the recipient’s information. The form contains various boxes for reporting different types of payments and withheld taxes.

Reporting 1099-MISC on Your Tax Return

Receiving a Form 1099-MISC means you need to report the income shown on it on your tax return. While you don’t need to file the form with your taxes, you must keep it for your records. You can also deduct any taxes withheld, including state and local taxes, on the appropriate return.

The Main Difference Between 1099-MISC and 1099-NEC

The 1099-MISC and 1099-NEC are two different forms of reporting income to the IRS. The 1099-MISC covers various types of miscellaneous income not subject to self-employment income including rent and prizes, while the 1099-NEC is specifically for reporting payments made to nonemployees like freelancers and independent contractors.

Let Tax Samaritan Handle Your Tax Worries

In summary, Form 1099-MISC is critical for reporting miscellaneous income to the IRS. Understanding the requirements and deadlines for filing this form is important to stay compliant with tax regulations. If you have questions about Form 1099-MISC, need expert guidance in tax preparation, or seek assistance with tax-related issues, don’t hesitate to contact us at Tax Samaritan. Your financial peace of mind is our priority.

All About Randall Brody

Randall is the Founder of Tax Samaritan, a boutique firm specializing in the preparation of taxes and the resolution of tax problems for Americans living abroad, as well as the other unique tax issues that apply to taxpayers. Here, they help taxpayers save money on their tax returns.