Filing Form 3520: How to Report Foreign Gift Tax

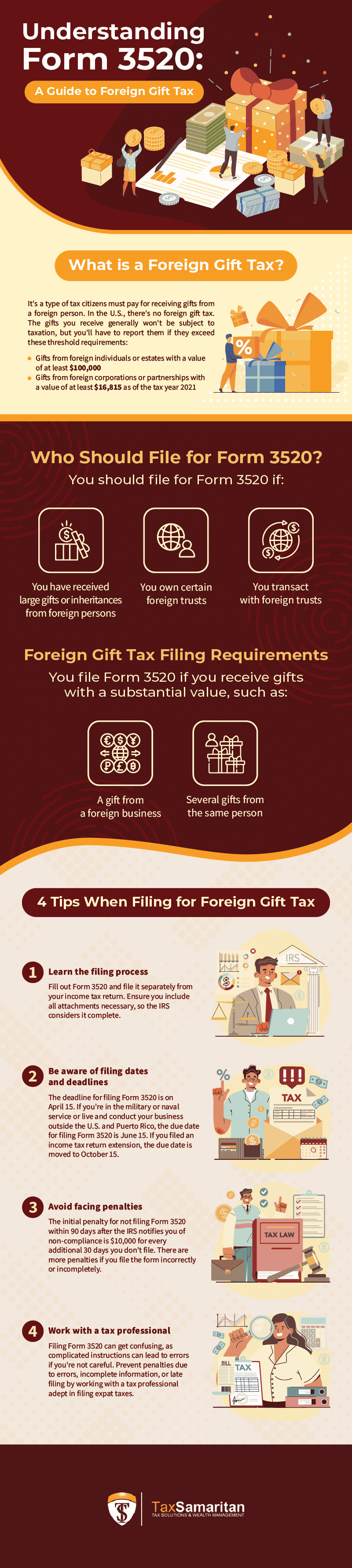

`Will you get taxed if you receive a gift from a foreigner? While the gift is not taxable to a recipient in most situations, you’ll need to report gifts if their value exceeds a particular threshold. This reporting rule is the purpose of Form 3520, which is the form you must file with the Internal Revenue Service (IRS) when you, a U.S. citizen, receive gifts or bequests from a foreigner.`Will you get taxed if you receive a gift from a foreigner? While the gift is not taxable to a recipient in most situations, you’ll need to report gifts if their value exceeds a particular threshold. This reporting rule is the purpose of Form 3520, which is the form you must file with the Internal Revenue Service (IRS) when you, a U.S. citizen, receive gifts or bequests from a foreigner.

While foreign gifts are typical for U.S. citizens, not everybody is familiar with Form 3520. The rules can be confusing, especially when you receive expensive foreign gifts for the first time.

Read the infographic and article below to learn more about Form 3520 and how it affects you as an expat taxpayer.

What is a Foreign Gift Tax?

A foreign gift tax is a kind of tax that citizens must pay for receiving gifts from a foreign person. A foreign person can be a nonresident alien individual, partnership, corporation, estate, or trust. The U.S. does not implement a foreign gift tax. Thus, the gifts you receive from a foreign source are not taxable.

However, you should report the gift to the IRS if its value exceeds a specific threshold.

- If you receive a gift from a nonresident alien or a foreign estate, you must report it if its value is more than $100,000 during a given tax year

- If you receive a gift from foreign corporations or foreign partnerships, you must report it if its value is more than $16,815 as of the tax year 2021

Remember, you generally don’t have to pay tax when you receive gifts from foreign or local nationals. However, if you’re giving the gifts and live in the U.S. or are a U.S. citizen, you may have to file a gift tax return and pay gift tax. To report your gift, you must file Form 3520: Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts.

Who Should File for Form 3520?

Now that you know what Form 3520 is, you must determine your eligibility when filing this form. As an expat, you can file Form 3520 if you have received certain large gifts or inheritances from foreign persons.

4 Tips When Filing Form 3520

The instructions for filing Form 3520 or foreign gift tax are complicated, even for seasoned accountants. There are several elements you should review when filing. Here are some tips to help you efficiently file Form 3520.

1. Learn the filing process

Fill out Form 3520 and file it separately from your income tax return.

2. Be aware of filing dates and deadlines

For individuals, Form 3520 is due every April 15 or the 15th day of the 4th month following the end of the U.S. tax year. If you filed for an extension on your income tax return, the due date for Form 3520 is October 15 or the 15th day of the 10th month following the end of the U.S. person’s tax year.

If you live and conduct your business, have your post of duty, or are in the military or naval service outside the U.S. and Puerto Rico, your filing deadline for Form 3520 is June 15 or the 15th day of the 6th month following the end of your tax year.

When the deadline for filing is on a Saturday, Sunday, or a legal holiday, you can file the form on Monday or the next working day.

3. Avoid facing penalties

If you don’t file Form 3520 within 90 days after the IRS notifies you of non-compliance, you’ll face an initial penalty of $10,000 for every additional 30 days you don’t file. If you file the form incorrectly or incompletely, you’ll get a fine amounting to 5% of the gift’s gross value for every month the form stands incomplete or incorrect. The penalty can be up to a maximum of 25%.

It’s in your best interest to comply with IRS regulations rather than risk getting a penalty. You must make the extra effort to file your forms correctly, completely, and on time. If not, you’ll be wasting money paying off penalties.

4. Work with a tax professional

Dealing with Form 3520 for the first time can be confusing and overwhelming. This makes it likely for you to make a mistake. Avoid facing penalties and ensure that your forms are filed accurately and on time by seeking the help of a tax professional.

You can receive the maximum penalty when you file a few months late or leave one blank line. Tax Samaritan experts are knowledgeable in filing expat taxes, so there’s no need to worry should you face tax issues.

When To File Form 3520

You won’t have to pay taxes on foreign gifts you receive. However, there’s a caveat. While the U.S. has no foreign gift tax, you must disclose gifts when their value exceeds the limit. If you don’t, you’re most likely to face hefty penalties.

You’ll need to fill out Form 3520 if you are to report your large foreign gifts. It can be challenging to understand this form’s instructions at times. Nevertheless, you could properly file Form 3520 and other attachments by availing yourself of tax resolution services.

Tax Samaritan is a tax resolution partner offering best-in-class service. We have been a trusted provider of professional-quality tax resolution services to U.S. expats since 1997. Let us guide you in filing your expat tax forms.

All About Randall Brody

Randall is the Founder of Tax Samaritan, a boutique firm specializing in the preparation of taxes and the resolution of tax problems for Americans living abroad, as well as the other unique tax issues that apply to taxpayers. Here, they help taxpayers save money on their tax returns.