An Informative Guide on Different Tax Systems in the World

In the 1860s, the first federal income tax law was imposed by President Abraham Lincoln. The 3% levy coincided with the early stages of the American Civil War. As the war concluded, so did the people’s support for the tax law.

In 1872, the government repealed the system. It took more than 20 years for a new income tax system to be reintroduced via the Wilson-Gorman Tariff, which Congress passed in 1894. Since then, the United States’ income tax laws have continued to evolve.

Given how it’s the lifeline of any nation, it’s understandable that people continued to follow and support the tax mandate. An excellent taxation system results in well-funded public services that every citizen can enjoy. Collected funds may even be used for investment, leading to an exponential growth of a country’s economy.

Speaking of countries, tax systems around the world vary. So, if you’re planning to spend time abroad to work for an extended period or relocate there for good, it’s best to know what your tax obligations are—both there and in your home country. This infographic gives a rundown of different countries’ income tax systems.

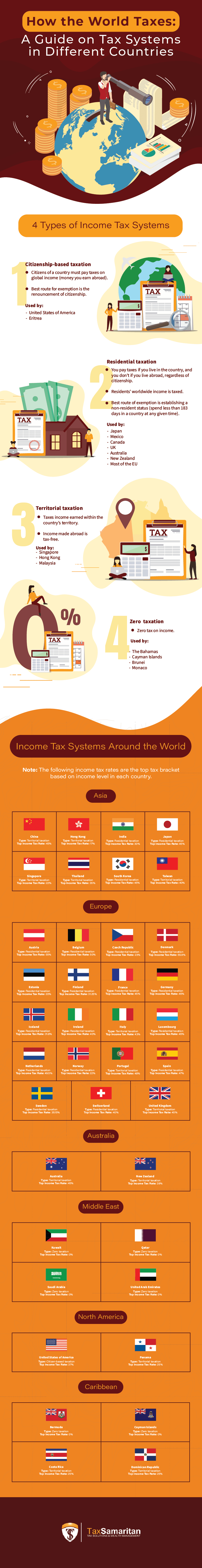

4 Types of Income Tax Systems

Governments worldwide impose different income tax systems based on the following.

1. Citizenship-based taxation

Under this tax system, you pay taxes by virtue of being a citizen, regardless of where your earnings hail from or the time spent in the country of your citizenship. If you’re an expat, you must report your global income on your annual tax return and the corresponding taxes paid. Internationally sourced income may be levied with a flat tax or separate taxes based on how they are earned.

Only two countries impose this income tax system: the United States and Eritrea. For the former, there are possible tax exemptions for income accumulated abroad, such as the Foreign Earned Income Exclusion.

2. Residential taxation

This is the least complex taxation system out there. It is also the most common, subscribed to by countries like Japan, Canada, Australia, Mexico, the United Kingdom, New Zealand, and most of the European Union. With the residential taxation system, you pay income taxes if you live in a country. Without a resident status, you don’t.

Certain standards govern whether a person is labelled a tax resident. The simplest of these requirements is the 180-day rule. That means that you qualify as one if you stay in a country for more than six months. Domicile, or having a home in a specific country, also determines tax resident status.

3. Territorial taxation

This is considered the friendliest tax system, especially for expats exploring worldwide income opportunities. If you reside in a foreign country with this tax system, you only pay taxes on income earned within the territory. For example, if you have investments abroad, the assets you gain from those remain tax-free. Countries that subscribe to this type include Singapore, Hong Kong, and Malaysia.

4. Zero taxation

Some countries don’t charge income taxes, such as The Bahamas, Cayman Islands, Brunei, and Monaco. However, those living and working within these territories are not entirely free of tax duties. Other types of taxes you pay from your earnings still exist.

For example, in The Bahamas, citizens pay Real Property Tax. All gathered legal documents entail Stamp Duties, too. Still, these prove to be more affordable than income and asset-related taxes you have to cater to under the three other tax systems. That is why countries with zero taxation rules, such as the United Arab Emirates and Qatar, prove popular among expats and digital nomads.

Income Tax Systems Around the World

Here’s a rundown of how different countries impose income tax among citizens, residents, and non-residents.

Note: The following income tax rates are the top tax bracket based on income level in each country.

Tax System in Asia

Tax rates are vital in Asia as many countries are developing regions. Some Asian countries with the highest tax rates are China (45%), Japan (45%), and South Korea (45%). Meanwhile, Hong Kong (17%) and Singapore (22%) have low tax rates.

Tax System in Europe

Most countries in Europe are under the residential taxation tax system. Denmark (55.9%) and Austria (55%) are the European countries with the highest tax rates. If you want to live in a European country with low taxes, Estonia (20%) and Norway (22%) are the way. Unlike most countries on this continent, Italy works on territorial taxation imposed in 2016 to attract high net worth individuals.

Tax System in Australia

Australia and New Zealand are under residential taxation tax systems with tax rates not far apart. Australia’s tax rates are higher (45%) than New Zealand’s (39%). According to the Australian Government, the country’s tax may be higher, but “Australia has relatively low average and marginal tax rates at low-income levels, but relatively high marginal tax rates at high-income levels.”

Tax System in The Middle East

Many major Middle Eastern countries have zero taxation for individual income. But, in countries like Saudi Arabia, taxation occurs for corporate entities. The Middle East doesn’t rely on direct taxes but indirect taxes like custom duties, goods, and services.

Tax System in North America

The United States of America is the most well-known country with a citizen-based taxation system. Whether you live in the US or abroad, you’re taxed on the same personal income tax system as a US citizen.

Tax System in the Caribbean

Numerous wealthy individuals and businesses choose to live in the Caribbean to take advantage of the continent’s little to no tax liability. The Caribbean is popular for being home to several tax havens. Countries like Bermuda and the Cayman Islands have zero taxation, while Costa Rica and the Dominican Republic have low tax rates (25%).

Tax From One Country to Another

While abroad, you may have to pay taxes to the government of your host country. So, it’s crucial to learn what tax systems for expats apply to the country where you are. This will spare you from overstepping the bounds of the law, which can entail serious repercussions and unpleasant surprises.

Remember that you also need to file your U.S. income tax returns to the Internal Revenue Services (IRS). You must file them yearly and pay the corresponding taxes.

If your absence from the country has derailed your tax compliance, do not fret. There are tax resolution services at your disposal. Should you need a tax resolution partner, Tax Samaritan offers the best-in-class service. Don’t hesitate to reach out.

All About Randall Brody

Randall is the Founder of Tax Samaritan, a boutique firm specializing in the preparation of taxes and the resolution of tax problems for Americans living abroad, as well as the other unique tax issues that apply to taxpayers. Here, they help taxpayers save money on their tax returns.