How To File Appeals To The IRS — Ultimate Guide Here

When the Internal Revenue Services (IRS) performs an audit of your finances, you’ll receive an audit report by the end of the process. This report is a notification letter that explains their findings and proposed changes on how you can get back to compliance. Usually, the notice will state that you owe the IRS a specific amount of money, including interests, back taxes, or penalties.

If you agree with the audit report, you can simply pay the assessed amount and sign the agreement form. However, if you disagree with the amount you owe, you have the right to appeal and ask for IRS appeals representation.

The IRS provides an appeals process that is “fair and impartial to the government and to you.” You can resolve your tax dispute through a separate entity called the IRS Independent Office of Appeals without going to the Tax Court.

How to File Appeals to the IRS

The infographic and article below will further discuss the appeals process, including how expat taxpayers can effectively file a tax appeal to the IRS.

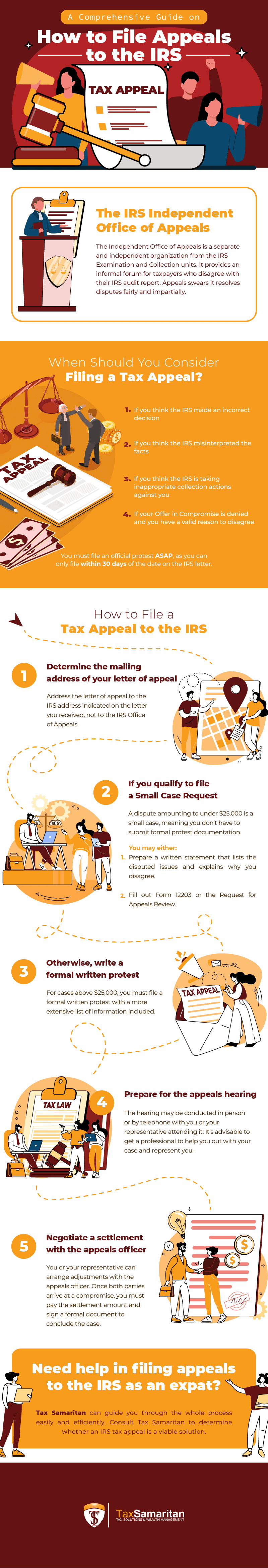

The IRS Independent Office of Appeals

Founded in 1927, the Independent Office of Appeals works independently from the core operations of the IRS. That is despite it being a working group within the tax enforcement. The goal of the IRS Office of Appeals is to impartially resolve tax disputes following an audit conclusion.

It may seem counterproductive to appeal to the IRS because it’s a tax-collecting agency, but the IRS makes it clear the Office of Appeals is a standalone group. By recognizing the group’s independence, the IRS can boost its agenda of taxpayer compliance.

When Should You Consider Filing a Tax Appeal to the IRS?

-

If you think the IRS made an incorrect decision

You should check IRS publications and the Tax Code that discusses your issue if you believe the IRS has misinterpreted the law, resulting in an incorrect decision. Look at your case from another point of view to determine if the IRS’s decision was fair and has a legal basis.

-

If you think the IRS misinterpreted the facts

It’s in your best interests to be prepared to clarify and support your position. For example, if you want to appeal that your claim for a home office deduction is legitimate, you can present copies of relevant documents to support your appeal.

- Bills incurred in your home office

- A floor plan of your space showing the area you use as a home office

- A business diary that proves you spend a significant number of hours working in your home office

-

If you think the IRS is taking inappropriate collection actions against you

Suppose the IRS sends you a Notice of Federal Tax Lien Filing, but you believe you don’t owe them the stated amount. According to the Collection Due Process (CDP), you can request a CDP hearing if you deem the lien inappropriate.

-

If your Offer in Compromise is denied and you have a valid reason to disagree

If you wanted to settle your tax bills but the IRS denied your Offer in Compromise, you can raise your concern to Appeals. Be prepared to explain and support your disagreement with their decision. The Office of Appeals will hear your reasons why you disagree, given that your grounds aren’t solely due to political, religious, or moral beliefs.

Remember that while you can file for an appeal, this right is only valid for a certain period. You can only file an official protest within 30 days of the date on the IRS audit report or notification letter.

How to File a Tax Appeal to the IRS

-

Determine the mailing address of your letter of appeal

A common mistake many people make is addressing the letter of appeal to the IRS Office of Appeals rather than to the IRS address indicated on the letter you received. Committing this error can lead to delaying the IRS appeals process and possibly preventing the office from considering your case.

-

If you qualify to file a Small Case Request…

A protest is considered an informal Small Case Request if the total dispute amount (including IRS-assessed penalties) is below $25,000. Since a small-case request requires a simpler approach, you will be relieved of the obligation to submit formal protest documentation.

However, it’s best to support your position with facts and statements of the law. You may either:

-

Prepare a written statement that lists the disputed issues and explains why you disagree

In your written statement, lay out all your concerns regarding your case. You may also include your proposed adjustments to the report. You must address the letter to the contact person named in the letter and submit it within the allowed period.

-

Fill out Form 12203 or the Request for Appeals Review

Filing a Small Case Request requires you to submit Form 12203, a.k.a. Request for Appeals Review. In this form, you can list the items on the IRS examination report that you disagree with. There’s also a space where you can briefly explain your position.

You are not allowed to file a Small Case Request if you’re filing as:

- A partnership

- An S-Corporation

- An employee plan

- An exempt organization

-

-

Otherwise, write a formal written protest

If you aren’t qualified for a Small Case Request, you must file a formal written protest. It should include the following information:

- Aspects of the IRS proposal you disagree with

- Reasons you disagree with the said proposal

- Facts supporting your reasoning

- Relevant laws supporting your stand

-

Prepare for the hearing of the appeal

If your case qualifies for an appeal, the Office of Appeals will schedule a conference with you after reviewing your case. Appeals can hold the hearing in person or by telephone. You have the right to represent yourself or hire an expert that provides tax resolution services to stand for you. They can advise you on how to prepare for the hearing and which documents and statements Appeals will look for.

-

Negotiate a settlement with the appeals officer

Together with helping you prepare a strong protest letter, your representative can negotiate a good compromise on your behalf. If both parties agree, the IRS Appeals Officer will issue a Form 870 or the Consent to Proposed Tax Adjustment. Once you sign this document, you’ll pay the settlement amount and no longer challenge the existing tax case.

Make a Successful Appeal

If your tax audit report seems inaccurate and unreasonable, you have the right to appeal to the IRS. The Office of Appeals will look into your case and decide impartially, making the whole process fair to you and the IRS.

Boost your chances of getting a successful appeal by getting a tax professional. Tax Samaritan has been providing professional-quality tax resolution services to expats since 1997. Our team of enrolled agents can help you reduce your tax liability and avoid litigation. Get a Free Tax Quote →

All About Randall Brody

Randall is the Founder of Tax Samaritan, a boutique firm specializing in the preparation of taxes and the resolution of tax problems for Americans living abroad, as well as the other unique tax issues that apply to taxpayers. Here, they help taxpayers save money on their tax returns.