How to Avoid Committing Tax Fraud: A Warning

No tax fraud is small, as the Internal Revenue Service (IRS) treats all tax violations seriously. However, you can immediately correct and stop it as soon as you spot it. As a first step, you need to be aware of how tax fraud happens.

It’s possible that you’re committing tax fraud without you knowing it. Therefore, it’s crucial to familiarize yourself with its different forms and how to avoid them. This infographic will provide a visual guide on everything you need to know about tax fraud.

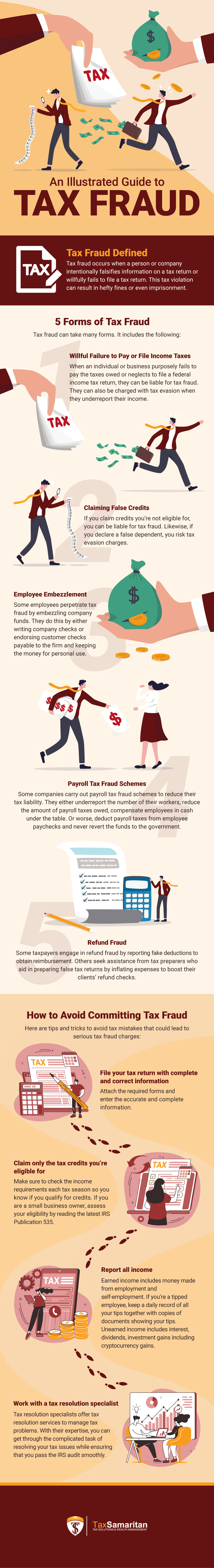

Tax Fraud Defined

Tax fraud happens when a person or company intentionally falsifies information on a tax return or willfully fails to file a tax return. Also referred to as tax evasion, it involves using fraudulent or illegal means to avoid paying taxes. This violation can result in civil and criminal charges, hefty fines, or even imprisonment if convicted.

5 Forms of Tax Fraud

Tax fraud can take many forms. It includes the following:

1. Willful Failure to Pay or FIle Income Taxes

When an individual or business purposely fails to pay the taxes owed or neglects to file a federal income tax return, they can be liable for tax fraud. Underreporting their income can also lead to tax evasion charges. Note that the IRS requires that all income be reported, including money earned from the sale of goods, tips, and even casino winnings.

2. Claiming False Credits

Another common form of tax fraud is claiming credits you don’t qualify for. For instance, if you report education credits you’re not eligible for, you can be liable for tax fraud and can be banned from claiming the credit for up to 10 years. If you declare a false dependent, you also risk a potential audit from the IRS and sanctions, as this is considered tax evasion that may carry with it severe criminal penalties.

3. Employee Embezzlement

In some instances, it is the rank-and-file employee who perpetrates tax fraud by embezzling company funds. They steal from the organization’s financial assets by writing company checks or simply making electronic payments to themselves. Endorsing and cashing customer checks payable to the company, then keeping the funds for personal use are all considered embezzlement.

When someone is convicted of embezzlement, there are tax implications. Based on an IRS ruling, the embezzled money is taxable as an income; therefore, the amount will be included in the embezzler’s gross income for the year the felony was committed. In addition, the employee may be subject to self-employment taxes on the stolen amount.

4. Payroll Tax Fraud Schemes

Some companies carry out payroll tax fraud schemes to reduce their tax liability. These include underreporting the number of workers, collecting payroll taxes and not paying them over to the IRS, and compensating employees in cash under the table. In other cases, the employer falsifies payroll records by reducing the amount of payroll taxes owed.

Failure to properly remit employment taxes is a major tax violation. As such, conviction on one count of employment tax fraud could mean five years behind bars. The IRS routinely investigates employment tax scams, requiring audits for companies with questionable returns.

5. Refund Fraud

Some individuals and corporations engage in refund fraud to obtain reimbursement. They report fake deductions, exemptions, or business expenses. Others seek assistance from tax preparers who can aid in the preparation of false tax returns. These preparers report inflated costs and claim non-existent credits to boost their clients’ refund checks.

This form of tax fraud has severe consequences for both the preparer and the client. The criminal charges can result in imprisonment or a fine of up to $100,000 (for individuals) or $500,000 (for corporations).

In addition, a tax fraud case can involve a restitution order, where the court directs the person convicted of tax fraud to pay the taxes they failed to report or settle. They can also be required to pay the costs of prosecution, which can reach $5,000 or more.

How to Avoid Committing Tax Fraud

Here’s how you can avoid tax mistakes that could lead to serious tax fraud charges:

1. File your tax return with complete and correct information

When filing your tax return, be sure to attach the required forms and enter accurate and complete information. For instance, if you paid thousands of dollars to attend college this year, you may qualify for an education tax credit, which can reduce your taxes. In this case, you must attach Form 8863 to your tax return.

Forgetting to include the necessary attachments or incorrectly reporting important data, such as your Social Security number, are red flags to the IRS that can lead to an audit.

2. Claim only the tax credits you’re eligible for

Claiming an earned income tax credit (EITC) you’re not qualified for can be a major IRS audit trigger. To avoid committing this tax fraud, make sure to check the updated income requirements each tax season so you know if you are eligible to claim the credit. Note that the EITC limits vary from year to year, so pay close attention to the updated guidelines for the taxable year.

If you are a small business owner, you can claim deductions on your business expenses. Generally, you can deduct the full amount of the business cost if it meets the criteria set by the IRS. Just make sure to assess your eligibility first by reading the latest Publication 535, as it details the requirements for deductible business expenses.

3. Report all income you earned

Earned income covers money made from employment, such as wages, salaries, and tips. It also includes earnings from self-employment, including freelance work, selling goods online, and running a business.

Union strikes and long-term disability benefits are also considered earned income.

If you’re a tipped employee, keep a daily record of all your tips together with copies of documents showing your tips like restaurant bills and credit or debit card charge slips. You can use Form 4070A to organize your data. Also, remember to read the newest edition of Publication 525 to keep track of what the IRS considers taxable and nontaxable income.

4. Work with a tax resolution specialist

Tax resolution specialists offer tax resolution services to help individuals and companies manage their tax problems. These experts have extensive experience working on IRS mechanisms such as penalty abatement, offer in compromise, and installment agreements. By seeking help from a tax specialist, you can resolve your tax issues while ensuring that you pass the IRS audit smoothly.

Understanding Tax Fraud Helps You Avoid Charges

There may be instances where you unconsciously commit tax fraud, like when you inadvertently misreport your income. At first glance, it seems harmless; however, under IRS rules, this is automatically tax fraud. As such, you must be aware of the different forms of tax fraud so you can avoid committing them. By knowing how it happens, you can be protected from potential fines and prison sentences.

If you need a tax resolution partner for your tax problems, Tax Samaritan offers the best-in-class services. We can help sort out your tax issues so you won’t have to fear an IRS audit again.

All About Randall Brody

Randall is the Founder of Tax Samaritan, a boutique firm specializing in the preparation of taxes and the resolution of tax problems for Americans living abroad, as well as the other unique tax issues that apply to taxpayers. Here, they help taxpayers save money on their tax returns.