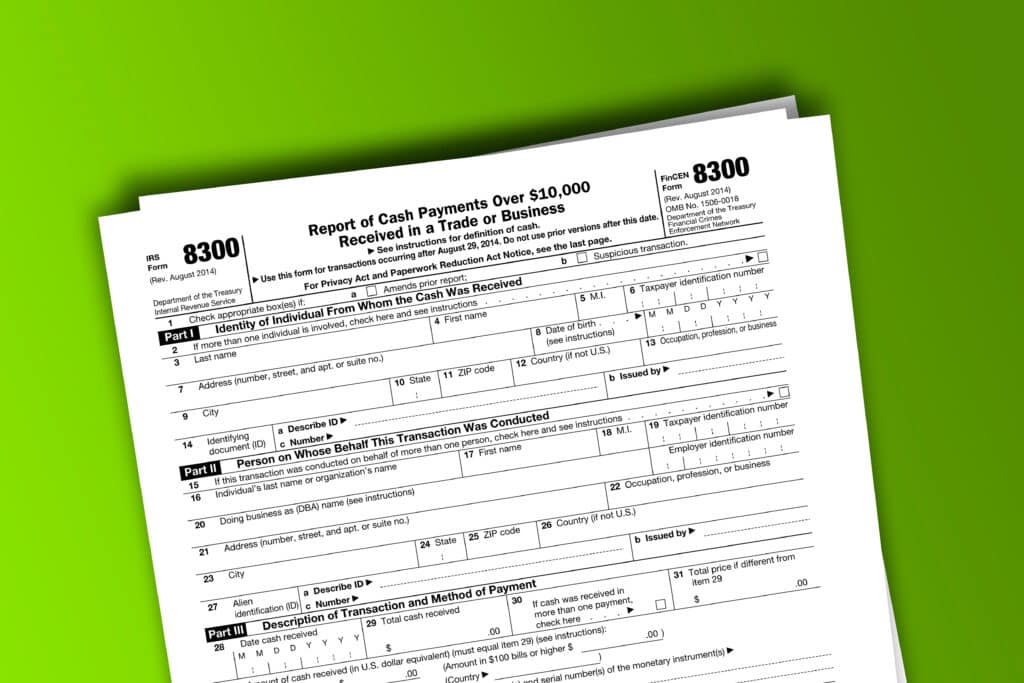

How to Report Cash Payments Over $10000 with IRS Form 8300

Despite the rise of electronic payments, cash transactions persist in business. While they offer convenience, they present challenges during tax preparation. The IRS is cautious because verifying them is more challenging, and there is a greater risk of tax evasion. This is why it created Form 8300. It ensures transparency and identifies large cash transactions.

The IRS Form 8300 tracks cash payments over $10,000 in a single business day. It helps the agency fight money laundering, tax evasion, and other crimes.

But who exactly needs to file this form?

Any taxpayer who operates a trade or business must file the form if they receive over $10,000 in cash. This must be from a single transaction or two or more related ones.

This applies to payments for the sale of goods and services, payments for tangible and intangible property, contributions to escrow arrangements, expense reimbursements, and loan repayments.

In addition, you must provide a written statement to each person mentioned on the form, informing them that you’ve filed the form with the IRS.

Failure to issue a written statement can result in penalties of $250 and up to $3,000,000 per calendar year.

Reporting Exceptions

Form 8300 does not consider all cash transactions equal. While the $10,000 threshold is the primary trigger for reporting, there are exceptions to be aware of. For instance, if you’re hosting a yard sale and someone buys your antique furniture for $12,000, and you’re not in the business of selling furniture, you don’t need to file Form 8300.

Another exception applies to transactions outside the U.S., the District of Columbia, or a U.S. possession or territory. This includes places like American Samoa, Guam, and Puerto Rico.

Banks and financial institutions filing Form 104, as well as casinos filing Form 112, are also exempt from reporting cash transactions on Form 8300.

Filing Deadline

You must file the form within 15 days of the cash transaction. You can file it electronically or on paper.

If your business already e-files at least ten information returns, such as Forms 1099 or W-2 in a year, you must also e-file Form 8300. You do this through the FinCEN BSA E-Filing System. But, if e-filing goes against your beliefs, you’re not required to do it. When you send paper forms, write “RELIGIOUS EXEMPTION” at the top center of each Form 8300.

You can also request a waiver for e-filing due to undue hardship. If the IRS grants it, you will not need to e-file Forms 8300 for the calendar year. When submitting paper forms, write “WAIVER” at the top center of each form.

If you’re required to e-file but file by paper and don’t have a religious exemption or waiver, you will be subject to a failure to file a penalty.

For those eligible for paper filing, you need to send the form to this address:

Internal Revenue Service

Detroit Federal Building

P.O. Box 32621

Detroit, MI 48232

Avoiding Pitfalls

Not filing Form 8300 can lead to severe penalties. You can face fines of up to $25,000 or criminal charges with up to $100,000 of fines and imprisonment for up to 5 years.

Taxpayers and businesses should focus on compliance to stay on the right side of the law. Transparent reporting and timely filing are your best defense against penalties and legal trouble.

If you’re unsure how to file or have questions about the form, please contact Tax Samaritan at 775-305-1040 for a free 15-minute, no-obligation consultation meeting.

All About Randall Brody

Randall is the Founder of Tax Samaritan, a boutique firm specializing in the preparation of taxes and the resolution of tax problems for Americans living abroad, as well as the other unique tax issues that apply to taxpayers. Here, they help taxpayers save money on their tax returns.