How to Claim Foreign Tax Credit in 4 Ways

No matter how far you travel from your home country, you can never get far enough away from taxes. You might even incur heftier taxes if you pay taxes in a foreign country and the U.S. Understandably, you want to reduce your U.S. tax bill. The good news is that you can avoid double taxation via the Foreign Earned Income Exclusion (FEIE) or Foreign Tax Credit (FTC), aside from the relevant tax deductions that already apply to you.

Maximizing your FTC will allow you to avoid double taxation and better fulfil your U.S. tax obligations. However, you must know the FTC’s limitations to get its full scope of tax advantages.

This article will focus on FTC, its limitations, and the rules you must meet to qualify.

What is the Foreign Tax Credit Limit?

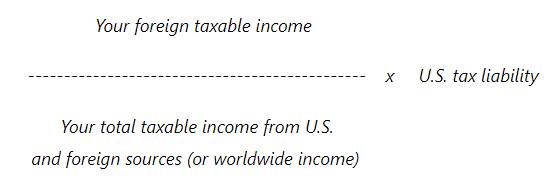

Foreign tax credit mitigates the amount of taxes you must pay to the United States. According to the Internal Revenue Service (IRS), your foreign tax credit cannot be more than your total U.S. tax liability multiplied by this fraction:

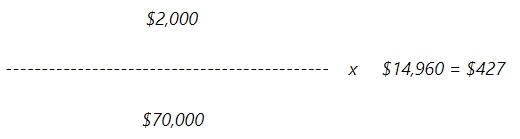

Suppose you have a worldwide income of $70,000. Out of this, $2,000 is from a foreign source. Your U.S. tax liability is $14,960, and you paid $500 as a tax on the foreign source income.

Your tax credit would be approximately $427.

Since it’s lower than the amount you paid on your foreign income, you will be eligible for the foreign tax credit. In other words, your foreign tax credit limitation or ceiling is $427.

If you have excess credit, the IRS allows you to carry it back to the previous tax year or carry it forward to the next 10 tax years, according to Publication 514. In the last example, you would have a carryover credit amount of $73.

The FTC differs from the Foreign Earned Income Exclusion (FEIE), which lowers your taxable income. Your foreign tax credits reduce the amount of tax you owe.

Foreign Tax Credit Limitations: 4 Rules to Claim Your Credit

There are foreign tax credit limitations that you need to account for before enjoying the benefits of the FTC.

The tax must be imposed on you

The FTC is limited only to the foreign taxes imposed on you in your country of residence.

For instance, the company you work for in a foreign country automatically deducts a portion of your income from taxes. That means it was imposed on you, making you eligible for the FTC.

You must have paid or accrued the tax

You won’t be eligible for FTC if you have not paid or accrued foreign taxes. The IRS expounds on these foreign tax credit limitations with three scenarios: if you file a joint return, if there’s an imposed foreign tax on your combined income, and if you’re a mutual fund shareholder.

If you have a spouse and file a joint return on your taxes, the total of any foreign income tax paid or accrued by you and your spouse will determine how much credit you can claim.

In a situation where the imposed foreign income tax is on the combined income of you and your spouse, your portion of the combined income will determine the amount of foreign tax you can claim. For example, if 40% of the combined income is yours, you can only claim 40% of the foreign taxes imposed on your U.S. income tax return, while your spouse claims 60%.

If you’re a mutual fund shareholder, the share of foreign income taxes paid by the fund will be the basis of the credit you may be able to claim.

The tax must be the legal and actual foreign tax liability

The FTC is only available for expats who live and work in a foreign country and receive tax-imposed salaries.

If you’re a self-employed individual who travels from one country to another and does not have imposed income taxes, you cannot claim FTC. Additionally, foreign government tax refunds must be subtracted from the amount of foreign tax that qualifies for the FTC.

The tax must be an income tax (or a tax in lieu of an income tax)

In general, the FTC is limited only to the following:

- Income

- War profits

- Excess profits taxes (also known as income taxes)

- Wages

- Dividends

- Interest

- Royalties

The IRS emphasizes that the tax must be a levy, not a payment for any specific economic benefit.

Manage Your Foreign Income Tax Credit with Tax Samaritan

Double taxation is a prevalent problem among expats, but you can avoid it through the Foreign Tax Credit. However, it can only provide relief up to a certain limit. You can’t pay more foreign tax than your U.S. taxes.

The eligibility rules for the FTC state that the foreign taxes must be mandatory, that you have either paid or accrued them, and that they qualify as foreign income tax.

Navigating tax credits can quickly become confusing, especially when dealing with taxes from two countries with different tax systems. Tax Samaritan offers the best in class tax resolution services to guide you through your unique tax situation. Get in touch with Tax Samaritan today to learn how we can help you.

All About Randall Brody

Randall is the Founder of Tax Samaritan, a boutique firm specializing in the preparation of taxes and the resolution of tax problems for Americans living abroad, as well as the other unique tax issues that apply to taxpayers. Here, they help taxpayers save money on their tax returns.