Tax Professional or CPA: Who Is the Best One for Your Expat Tax Problems

Have you ever been penalized for late filings, miscalculated tax returns, or late payments? Maybe you’ve been audited by the IRS? Or perhaps, you’ve been flagged for unpaid taxes? Well, if you’ve been there, you are not alone. Approximately 29.5 million taxpayers are penalized annually. Similarly, a staggering 20.1 million owe taxes.

Tax problems don’t end there. Almost 10.6 million individuals and 62.8 million businesses are considered non-filers. From these figures, one may conclude that filing taxes is no walk in the park.

The big question: Who should you call to solve your tax problems? A CPA or a tax expert? Check out this visual guide to find out. Let’s dot the i’s and cross the t’s on CPAs and tax professionals!

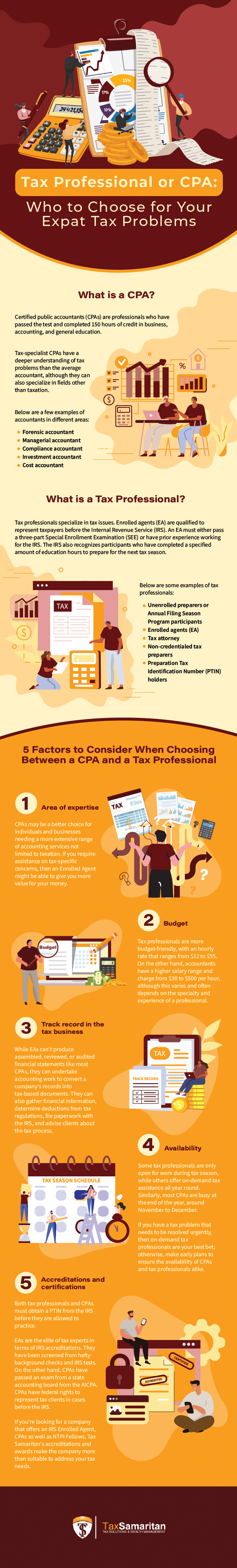

What is a CPA?

An individual must complete a test that covers a wide variety of accounting abilities to receive the title of a certified public accountant (CPA). Auditing, creating financial statements, comprehending corporate governance structures, and dealing with different company regulations (such as taxes and licenses) are just a few of a CPA’s responsibilities.

Upon passing the CPA test in 18 months, an examinee will be officially licensed by the AICPA.

However, even before taking the board exam, examinees must complete 150 hours of credit on business, general education, and accounting. A bachelor’s degree is also a requirement.

Tax-specialist CPAs have a deeper understanding of tax problems than the average tax practitioner but can also become experts in fields other than taxation. Below are a few examples of accountants in different areas:

- Forensic accountant

- Managerial accountant

- Compliance accountant

- Investment accountant

- Cost accountant

What is a Tax Professional?

Tax professionals specialize in tax issues. Compared to accountants, they may not often have the same broad educational background. Thus, the quality of their work might vary considerably. So, it’s important to evaluate several types of tax preparers before committing to one.

Enrolled agents (EAs) are qualified to represent taxpayers before the Internal Revenue Service (IRS). An EA must either pass a three-part Special Enrollment Examination (SEE) covering individual and company tax forms or have prior experience working for the IRS.

The IRS also recognizes participants in the IRS’s Annual Filing Season Program. These people are not considered lawyers, accountants, or enrolled agents, but they have completed a specified amount of education hours to prepare for the next tax season.

Below are some examples of tax professionals:

- Unenrolled preparers or Annual Filing Season Program participants

- Enrolled agents (EA)

- Tax attorney

- Non-credentialed tax preparers

5 Factors to Consider When Choosing Between a CPA and Tax Professional

Deciding between a CPA and a tax professional depends on your tax needs, situation, and comfort level. For simple returns, an ordinary tax preparer may suffice, but individuals with more specialized demands should seek out experienced pros.

Here are five key factors you should take into account.

Area of expertise

CPA qualification is the holy grail in accounting credentials, and many taxpayers value the security it gives. In addition to tax work, CPAs may be a better alternative for organizations needing a more extensive range of accounting services.

For instance, many CPAs provide financial planning, advising, and financial statement preparation. These can integrate with tax document filing, equipping you with tax strategies and an extensive plan.

Conversely, a tax professional’s concentration is smaller, but this may be a good alternative for clients needing tax-filing services solely.

Because the IRS officially provides an EA certificate, EAs frequently offer a unique perspective on dealing with complex IRS problems. For cost-conscious taxpayers, an EA is a better alternative than a CPA since the hourly charge is often cheaper. For self-employed people who compute for a rental property tax, or own foreign accounts, your best bet would be a tax professional like an EA.

Under tax professionals, you might also want to consider tax attorneys. These are lawyers who have mastered tax laws. State courts and state bar organizations recognize tax lawyers. In addition to a Juris Doctor diploma, they frequently hold a master’s degree in taxes.

Complex legal problems, such as drafting estate tax returns or bringing your case to the United States Tax Court, are best handled by tax attorneys.

-

Budget

Have you ever heard the saying that business is profit? To stay afloat, you’ll need to minimize your expenses. In the United States, the typical annual salary of a tax professional is $37,017. Their hourly rate ranges from $12 to $55. An accountant’s annual average pay, on the other hand, is $80,599 annually. CPAs usually charge either by the hour or at a fixed rate. Their hourly rate can be an average of $30 to $500.

Academic background, employment experience, and technical abilities determine a tax expert’s and CPA’s income. The size of the company they work for, the amount of work, and the cost of living in their location may all impact their pay. Comparing quoted fees and setting a budget can help you narrow down your options.

-

Track record in the tax business

An EA may be the most suitable choice if you need assistance with IRS issues, such as a collecting concern or an inspection. They’re in good standing with the IRS, and some EAs have even served as IRS agents before starting their own practice.

While EAs can’t produce assembled, reviewed, or audited financial statements like most CPAs, they can undertake accounting work to convert a company’s records into tax-based documents. You may then leverage this to file a tax return.

Another ace up their sleeves: EAs can gather pertinent financial information, enter relevant tax data, determine deductions with tax regulations, file paperwork with the IRS, and advise clients about the tax process. The list of what they can track just goes on and on!

Indeed, hiring a tax professional is a cost-effective strategy and ensures the timely submission of your tax returns. But remember, they generally work best for small businesses with simple taxes.

-

Availability

Some tax professionals open their doors during the tax season and close their services after April 15th. However, you may need to file tax returns or require assistance in responding to an IRS letter throughout the year. An easy fix is to look for experts who offer on-demand tax assistance all year round.

Another option: CPAs are usually hired for the rest of the year while tax preparers do their jobs on a project basis. So, if you think you’ll be needing tax assistance for the rest of the year, you might want to contact a CPA instead.

Then again, most CPAs are busy at the end of the year. Usually, their crunch times are from November to December. If you need a CPA in these months, it might be best to make arrangements in advance.

-

Accreditations and certifications

All tax professionals must obtain a PTIN (Preparation Tax Identification Number) from the IRS before they can practice. EAs are the elite of tax experts in terms of IRS accreditations. They have been screened from hefty background checks and IRS tests. Those approved without taking a test had most likely worked with the IRS, as well as continuously complete educational requirements every three years.

On the other hand, CPAs undergo different screening processes, which vary according to the state. A rule of thumb is that all CPAs must take an exam from the AICPA. Professional tax CPAs also need to acquire a PTIN. Accountants have federal rights to represent tax clients in cases before the IRS.

If you’re looking for a company that employs an IRS Enrolled Agent or an NTPI Fellow, Tax Samaritan possesses accreditations and awards that make the company more than suitable to address your tax needs.

The Bottom Line

Both CPAs and tax experts are qualified to help you resolve your tax problems. When choosing between an accountant and a tax preparer, it ultimately boils down to your needs and the size or nature of your business.

If you have complicated tax documents to file, an accountant can help you row against the tide. If you’re an individual or a small business, getting a tax professional can help you get the best value for your money. Just remember that you are solely responsible for your taxes. So, it would be best if you chose diligently.

Tax Samaritan is a team of reliable CPAs, Enrolled Agents, and tax professionals – well-versed in U.S. tax laws and can help you solve your tax problems seamlessly.

Perfect for expats, Tax Samaritan has been providing professional-quality tax resolution services since 1997. Get a Free Tax Quote now →

All About Randall Brody

Randall is the Founder of Tax Samaritan, a boutique firm specializing in the preparation of taxes and the resolution of tax problems for Americans living abroad, as well as the other unique tax issues that apply to taxpayers. Here, they help taxpayers save money on their tax returns.