Taxation of Cryptocurrency: Here is the Ultimate Guide for Beginners

The interest in cryptocurrency has grown remarkably over the past few years. It’s expected that about 37 million U.S. adults will own crypto by 2023. You can use these digital assets in multiple ways—as payments for products or services, investments, trading assets, or gifts.

Whatever you decide to do with your cryptocurrency, you must understand its tax implications. Taxes have a long history, and agencies are working on developing guidelines to match the times. The Internal Revenue Service (IRS) already has its eyes on cryptocurrency, and according to them, virtual currency is taxable.

Learn more about cryptocurrency tax in the infographic and article below.

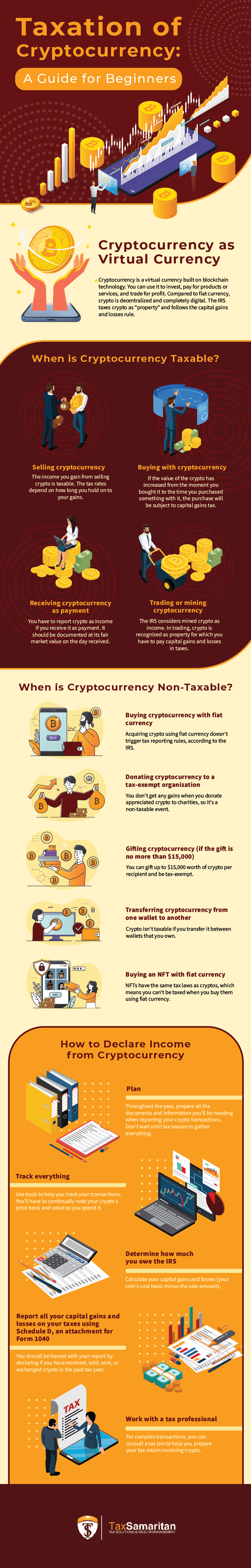

Cryptocurrency as Virtual Currency

Cryptocurrency uses cryptography to make secure transactions through a digital distributed ledger called blockchain. As a virtual currency, crypto functions as a medium of exchange, unit of account, and a store of value, much like fiat or “real currency.”

By comparison, fiat money is backed by governments or regulated by central banks, while crypto is decentralized, meaning no authority controls its value.

In the current state of crypto, you can use it to pay for flight or hotel bookings, trade for profit, or investment in start-up businesses. Due to these utilizations, the IRS finds that crypto is similar to other taxable assets such as gold or stocks, which is why the IRS taxes virtual currencies as “property.”

When is Cryptocurrency Taxable?

Even though it is viewed as a virtual currency, crypto has value and can be used for transactions much like fiat currency. Here are various circumstances when crypto becomes taxable.

Selling cryptocurrency

Like stock shares, you owe capital gains if you sell cryptocurrency at a profit. The IRS treats this as investment income, which is taxable. You must report these profits as a capital gain on Form 8949. Cryptos held for less than a year are considered short-term capital gains taxed at an ordinary tax rate.

Buying with cryptocurrency

Using cryptocurrency to buy goods and services will subject it to taxes. That is if the crypto increases in value between the moment you bought it and the time you used it to purchase something. For example, you bought one bitcoin for $5,000 last month. If you use the same coin to pay for a video game today at its current value of $8,000, you’ll have to report the transaction as a capital gain.

Receiving cryptocurrency as payment

Perhaps you have received cryptocurrency as an employee wage or independent contractor payment. In this case, as the employee or contractor, you’re responsible for reporting the crypto’s fair market value on your Form W-2.

If you have a business and your clients pay you in crypto, you must report it as business income. You may be able to exclude crypto as a taxable asset using the Foreign Earned Income Exclusion (FEIE) and passing it off as foreign source income.

Trading or mining cryptocurrency

Following the capital gains and losses rule, cryptocurrency trades are subject to tax liability. On the other hand, if you’re a crypto miner, the fair market value of the coins you mined is considered gross income. Your mining operations are also liable to self-employment tax if your activities involve a business or trade.

When is Cryptocurrency Non-Taxable?

If your transaction doesn’t fall in any of the scenarios mentioned above, then you might not need to file taxes for your crypto holdings. Here are some examples of when crypto taxation is not applicable.

Buying cryptocurrency with fiat currency

You don’t have to pay taxes on crypto if you bought it using fiat currency. It only becomes taxable when you sell it for fiat money. At that point, the trader will ask the cost basis of your virtual coin to verify if you need to pay taxes for capital gains.

Donating cryptocurrency to a tax-exempt organization

You’re exempt from paying capital gains taxes when you make crypto donations to qualified charitable organizations. You can do this by claiming a tax deduction to knock off the fair market value of your crypto at the time of the contribution.

Gifting cryptocurrency (if the gift is no more than $15,000)

Gifting crypto is becoming a norm nowadays. One in ten Americans participated in crypto gift-giving in the past holiday season. You shouldn’t worry about taxes if the virtual currency you’re giving isn’t more than the $15,000 gift tax allowance.

Transferring cryptocurrency from one wallet to another

You won’t owe taxes when you buy crypto and transfer it to your wallet. Even if you move these assets to another wallet you also own, there isn’t any tax liability with that activity. However, you should note your crypto’s original cost basis and date of acquisition to track its potential tax impact once you sell it.

Buying an NFT with fiat currency

A non-fungible token (NFT) is a digital asset stored on a blockchain. Since nobody can replicate them, NFTs are treated as collectibles. Examples include artworks, sports memorabilia, video game assets, and memes.

Similar to how crypto taxation works, purchasing NFT using fiat currency won’t subject you to taxes. However, once you trade, buy, or sell NFTs, the activity becomes a taxable event.

How to Declare Income from Cryptocurrency

The IRS views cryptocurrency as property and applies relevant tax guidelines and rules. If you have used cryptocurrency to buy, sell, and trade in the past few months, follow this step-by-step process to declare crypto as income.

1. Plan

Since cryptocurrency tax is newer and more complex than the usual tax setup, you must prepare months before tax season. Start gathering your reports to figure out how much you owe to the IRS in taxes. It’s best to treat crypto as a business. Be proactive by ensuring everything is updated and correctly tracked each month.

2. Track everything

Using crypto to pay for personal purchases may be easy, but tracking can be complicated since you have to determine which coin you used to buy, say, a cup of coffee. You also have to note the coin’s price basis and value at the time of transaction. Many crypto exchanges and blockchain-based apps can help you record your transactions and track your taxable events.

3. Determine how much you owe IRS

Figure out if your crypto transactions are subject to taxes. Then, calculate your capital gains and losses by subtracting the coin’s cost basis from the sale amount. The difference will tell you if you have capital gains or losses.

If you hold crypto for one year or less, your income becomes a short-term capital gain. Your federal tax rate may range from 10%-37%, depending on your tax bracket.

Beyond the one-year mark, your income becomes a long-term capital gain with 0%, 15%, or 20% tax rates, depending on your taxable income.

If your capital losses exceed your gains, you’re free to deduct up to $3,000 from your taxable income per year.

4. Report all your capital gains and losses on your taxes using Schedule D, an attachment for Form 1040

On your Form 1040 or U.S. Individual Income Tax Return, there’s a row in which you’re asked, “At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?” If you answer “yes,” the IRS will expect to see crypto transactions on your tax return.

You should include your capital gains and losses on the form’s attachment. Remember, the IRS expects you to be honest in reporting your income to stay compliant with the IRS.

5. Work with a tax professional

You can easily report your crypto earnings if you only have a few transactions. However, if your activities get complex, it’s best to work with a tax professional. They can help you understand tax rules related to virtual currency transactions, especially since there are many gray areas in IRS’ crypto tax guidelines. A tax pro can help you fill in the blanks and help you take the best approach when filing your tax return.

Start Planning Your Crypto Taxes

Although cryptocurrency has been enjoying continuous growth, crypto enthusiasts are not exempt from uncertainty during tax season.

The IRS has guidelines on how to tax cryptocurrency and decides if you can tax certain cryptocurrencies. However, because it’s a new tax aspect, many are still finding their footing. Fortunately, tax experts can help you in this department.

If you need a tax resolution partner to help you navigate crypto taxation, Tax Samaritan offers the best-in-class service.

All About Randall Brody

Randall is the Founder of Tax Samaritan, a boutique firm specializing in the preparation of taxes and the resolution of tax problems for Americans living abroad, as well as the other unique tax issues that apply to taxpayers. Here, they help taxpayers save money on their tax returns.